Key Quotes from B Capital | Antler Webinar Series: B2B SaaS Enterprises — From Inception to Growth

August 28, 2020

I had the privilege of organising a panel discussion co-hosted by B Capital and Antler to talk about the journey of B2B SaaS enterprises — how Asia SaaS companies rapidly build and scale to meet growing global demand, especially in a post COVID-19 world.

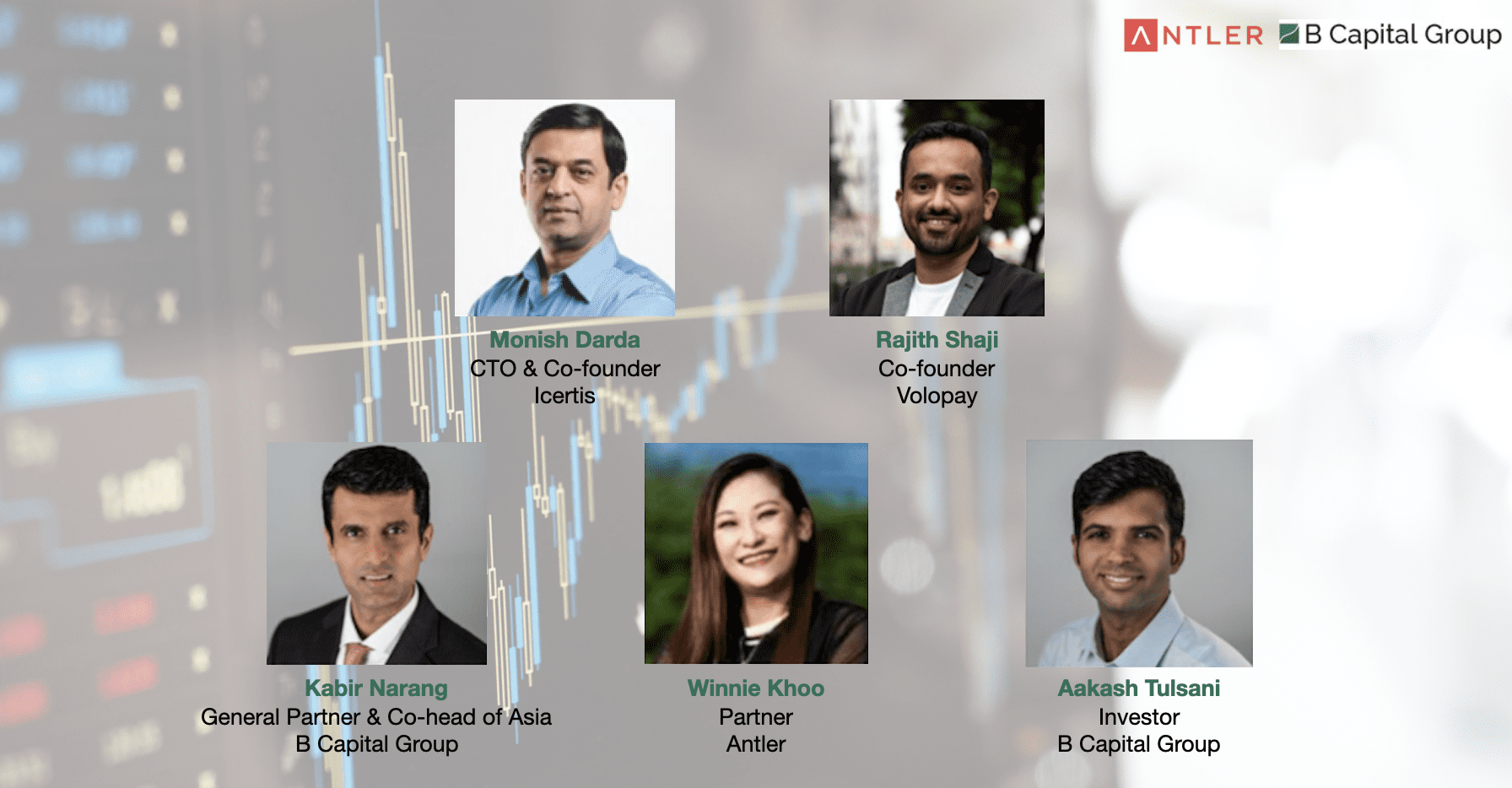

In the panel discussion, we had views on B2B SaaS companies from founders’ who have done or are currently doing it, as well as the perspectives of early to growth stage investors. On the investors side, we had Kabir Narang, General Partner and co-head of Asia at B Capital Group, and Winnie Khoo, Partner at Antler in Singapore. On the entrepreneurs side, we had Monish Darda, Co-founder and CTO of Icertis, and Rajith Shaji, Co-founder and CEO of Volopay. The panel was moderated by Aakash Tulsani, investor from B Capital Group. Here are the key quotes from the event.

Aakash highlighted the evolution and recent accelerated journey of the SaaS and Cloud industry.

“Over the past decade, it has generated a US$1.5T market cap at an incredible pace and this seems to be just the beginning for the SaaS and Cloud industry. A lot of great companies have been born in the last few years, but still a lot of enterprise workflows are not on cloud.”

“The global pandemic has impacted current customer behaviors and how we consume content. However, for the SaaS enterprises industry, it made people aware how remote sales can be successful.”

Kabir shared how should founders and investors react to the pandemic.

“I often get asked: what should founders and investors do in a period of deep recession and global pandemics? If you are a founder, you probably want to run your business for 15–20 years. If you are an investor, you want to choose companies that are durable, which are going to stand the test of time. This might sound crazy, but in the middle of a recession, it is probably the best time for investors to learn, observe, and see how companies are reacting. Similarly for companies, how you show resilience, but also how you have one eye on managing the current pressures, and see whether you are well-positioned to make the most out of the current opportunity.”

“I know it’s a hard time, but it’s also a very interesting time for me as an investor, to observe and learn. And it is the same for startup founders, to really use this time to solidify, become stronger, and see that you can actually emerge and bounce back.”

Kabir shared what is the advantage of looking at SaaS companies through a global lens.

“There are advantages for both investors and companies. From the investors’ standpoint, they can use the metrics in different parts of the world and use them to gather more data and make more informed decisions. You also get a better sense of competition — who are competitors in the US, Asia, and Europe. It’s just a larger addressable market. From the founders’ perspective, there is a bigger supply of talent in the global pool. The way people are building businesses right now make it a lot more possible, which was not the case 15 years ago.”

Monish and Rajith shared how do they pick investors when building a large SaaS business.

“What I’m looking for in an investor is literally my “alter ego”. It essentially means that you want someone who is passionate about what you’re doing, whom you can trust implicitly, who is behind you in the bad times, and who is always your best advisor. An ideal combination would be turning an investor with these features into a friend. At Icertis, after many years of working together, we are friends with our investors and we believe in the same objectives. We are constructively critical towards each other, which is very healthy to keep the teamwork going.” Monish Darda

“We also look deeply into the problem statement. How painful is the problem you are trying to solve? Here, we see a shift from “it’s nice to go digital” to building digital solutions that actually increase the bottom line and bring cash flow. Currently it is more about survival pain points rather than “nice-to-have” pain points.” Rajith Shaji

Monish shared what tough decisions did he have to make while building a SaaS company.

“We started our business in the tail of the downturn in 2009. When it comes to making hard decisions, there are 3 things that I learnt in my founder journey. First thing that comes to my mind is our decision at an early-stage to choose a platform on which we wanted to build our product. In theory, it was purely a technical decision, but we decided to make it a business decision. We asked ourselves, “which option is better for our business to go forward?”. The key learning from this experience is that the platform on which you choose to build should be good but it doesn’t have to be great. Hence, choosing a platform should be a business decision. Secondly, when including a new feature, there has to be a business reason to back up the decision; not your emotions. When people suggest to us that we expand into certain, potentially attractive areas, we say that our focus is extremely critical. Lastly, the thing that held the whole company together in these difficult times were our values. Early stage companies usually do not pay enough attention to defining them, however, values make the business grow well and facilitate making the right decisions.”

Monish shared how does one start the sales engine when fighting for first customers.

“There are 3 things that need to come together: 1. product fit, 2. right pricing and positioning strategy, and 3. making sure that you can leverage your first sales, meaning that your customers will sell to your next customers. On top of that, there is serendipity. You need to make sure that your execution is perfect, but you also have a good dose of luck that goes with it. To increase your luck, make sure that when you are talking to your customers, you are caring about them and loving the product. It will be easier to have them when you get the next customers. Now, in times of the global pandemic, lock-downs enabled remote selling, even at the large deal level. It can facilitate the process of staying in touch with your first customers as you no longer have to waste time on catching a plane just to join a half hour meeting.”

Rajith shared what advice would he give to people who are thinking about starting their business now.

“My advice would be to keep your focus on just one metric that makes you grow. Do not get distracted by endless opportunities — potential product features or potential partnerships — that do not necessarily make sense at your early stage. It might seem obvious but I believe that this may be the hardest thing in building a startup.”

Winnie shared what does she look out for when she is investing in early-stage SaaS startups.

“Recently, we have seen a lot of changes in businesses that startups pitch to us. On a general note, we are looking for businesses that are easy to scale. The correct execution of an early stage startup involves optimal customer acquisition cost and the retention friendliness of B2B SaaS products.”

“We also look deeply into the problem statement. How painful is the problem you are trying to solve? Here, we see a shift from “it’s nice to go digital” to building digital solutions that actually increase the bottom line and bring cash flow. Currently it is more about survival pain points rather than “nice-to-have” pain points.”

“In terms of investing, there is also a change in the environment. Due to the fact that B2B solutions are so product focused, the runway is much longer. We are very careful that the companies do not get stuck in a situation where they do not have enough funding to finish the product or to prove their market fit. They will not get investment if they do not have enough traction.

Winnie shared what are the investment criteria that she look at when it comes to competition.

“When we look at the business, competition is one of the key factors that we take into consideration. Generally, in South-East Asia, we typically like to look at businesses that have proven model somewhere else, and that have not yet been done in our location. If the founders can conquer the market, having competition is good. Moreover, in South-East Asia the market is very fragmented, so it is very hard to find one clear winner in every one of the different segments. For this reason, the competition actually tells us that this model is validated.”

Click here to watch the webinar replay.