Female founders: four things investors want you to know

November 11, 2020

As a female in the venture capital industry, it can sometimes feel like terms such as gender parity, female empowerment, and equal opportunity are used as buzzwords more than guiding principles. While the industry has been improving in recent years, today we still see 68% of venture firms without a single female partner. Last year only 2.8% of capital invested across the entire U.S. startup ecosystem went to all-female founding teams, while a whopping 11.5% of all venture capital went to mixed-gender founding teams. Clearly, we are on mile one of the marathon to fix this imbalance.

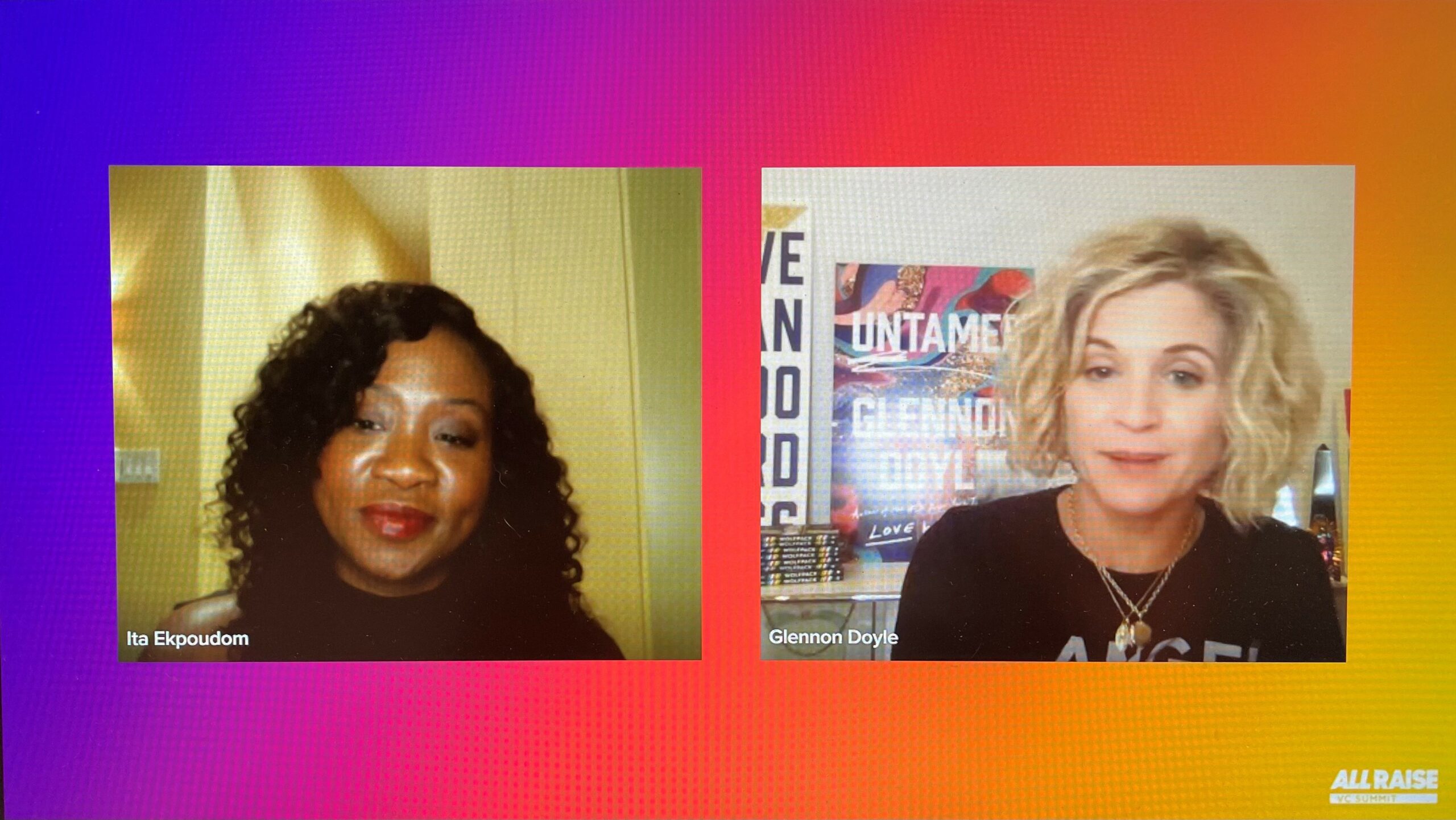

To continue fixing this problem, it is important for Female founders to be armed with the right advice from those who have traveled this path before on both sides of the table. I was fortunate enough to attend the virtual 2020 All Raise VC Summit. If you are not familiar with All Raise’s mission, they are accelerating the success of female founders and funders to build a more equitable future. B Capital was honored to sponsor this year’s event, All Raise’s third annual summit, which included keynotes, topical breakout sessions, and a fireside chat with (my absolute favorite author!) Glennon Doyle, all focused around this year’s theme, “Forces of Nature.”

This year’s theme is especially fitting for the world we find ourselves in today, where the bar for women is that much higher than it is for men to secure a seat at the table. The All Raise conference had a great mix of speakers from both sides, and here are the top four things I took away:

1. Choose your partners wisely

When you are deciding what you want to do with the next 10+ years of your life, you need to be ruthless about selecting the right partners to support you on this journey. This could include the obvious players like a co-founder or other executives at your company, but also includes the composition of your board, external partners, and mentors. Think about what support you will need as a leader to build the company that you set out to build and surround yourself with those allies in every circle.

2. What you do after getting a “no” will uncover the path to “yes”

When an investor does not end up participating in the round, it is crucial to pinpoint their reason for passing instead of politely excusing yourself from the conversation. By boiling down the no to a specific reason, you can figure out if you are not articulating something well, if the roadmap is unclear, or if a competitor is winning in a specific area. This will give you the opportunity to refine the perception in the market and will also give you conviction for the yes’s that come down the road.

3. Be open and vulnerable with your board

The goal of a board meeting is not to get an A+ on your “board test,” but instead should be viewed as a two-way street. Your board should let you know what is important for you to work on in order for their firm to continue investing time and money in your vision. Similarly you should let them know what they should be working on by calling them informally several times each year and giving assignments or focus areas for them to think about ahead of the upcoming board meeting. By getting early buy in from your partners, you share the big decisions and can have an open dialogue during the board meeting.

4. Back yourself

Women tend to downplay our accomplishments and ambitions as we have been conditioned to do our entire lives. To be a founder takes an incredible amount of energy to believe in yourself and your strategy. It takes even more energy to convince the doubters who have not seen women in your position before, so will be biased to think you aren’t up for the challenges ahead. By backing yourself you give others the permission to back you and believe in your vision.

I am thrilled to be at a firm where women are in leadership positions on every team and are using their voices to amplify the message of so many women who are not yet at the table. I’m looking forward to running the remainder of this marathon with all of the amazing Female founders and investors in the VC ecosystem, and one day looking around to see that these “forces of nature” make up 50% of every table.

Learn more about B Capital Group:

Are you a female founder looking for investors? Get in touch: Hello@BCapGroup.com