Key Quotes from Tech Bytes event: The SaaS Launchpad — exclusively brought to you by B Capital & BCG

October 6, 2020

Tech Bytes series is webinar series brought to you by B Capital Group and Boston Consulting Group. Each session will cover/dive into a different tech related field. For the inaugural event, I had the privilege of organizing a panel discussion to discuss the importance of new SaaS business models and their global relevance.

As Asia Pacific is witnessing unprecedented rates of technological disruption and innovation, the region is the new bed for budding SaaS startups. SaaS has become a disruptive force in every industry and has fundamentally impacted all aspects of business operations and how value is delivered to customers. Achieving business success today is impossible without SaaS technology that can enable customer centricity at enterprise scale.

Growing companies are starting to realize the benefits of adopting SaaS solutions across new and exciting parts of the business, and demand has grown for new solutions. Southeast Asia has seen an explosion of new SaaS concepts that address everything from customer care, inventory and supply chain and financial management. We are even seen surprising merger opportunities as very large companies look to acquire SaaS solutions that strengthen their vertical tech stacks and improve performance across the enterprise.

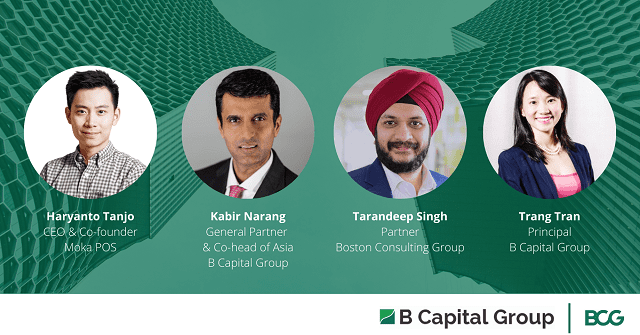

In the panel discussion, we were joined by key investors and leaders from B Capital Group (Kabir Narang, General Partner & Co-head of Asia) and Boston Consulting Group (Tarandeep Singh, Partner) as they delve into the topic and chat with our special guest, Haryanto Tanjo, CEO & Co-Founder of Moka. They discussed the types of exciting and relevant business models enabled by SaaS technology that would take the world by storm for the next few decades to come. Haryanto also drew on his experience and shared advice on how to successfully grow and scale a new SaaS company. Here are the key quotes from the event.

Trang highlighted that SaaS adoption has been growing at accelerated pace globally and Asia is the market seeing the fastest growth rate.

“In terms of sector penetration, the SaaS trend started with CRM but it has now penetrated every other sub-sector from human capital management, IT service, office collaboration, to verticals such as building management, logistics, manufacturing, financial services and so on. This transformation has created tremendous value for SaaS companies which are valued anywhere between 2–3x or higher than traditional software companies. Just to give a flavor of the growth of different sub-sectors of Enterprise software within Asia, what we are seeing is that CRM is a big sub-sector across on-premise and cloud-based model and it will continue to be the leading sub-sector in terms of growth going forward followed by ERP and BI.”

Haryanto shared his Moka story and journey (such as his vision, how he started and where Moka is now) from inception till its recent successful acquisition by GoJek.

“From day 1, the mission statement of Moka has been to empower merchants to sell and grow and while we had done a good job in fulfilling the first part of the mission statement (which was to empower merchants to sell more efficiently and run their business better), the second part (in helping merchants grow) was much more difficult without having control over the consumer side. With GoJek, we were able to tap into their millions of consumers to drive traffic and growth to the merchants. So joining forces made a lot of sense for both companies. We were able to realize a lot of synergies and create a more integrated product experience as we marry the consumer platform with the merchant platform.”

Tarandeep shared his recommendations for SaaS CEOs on the 3 most important business metrics to focus on.

“The number 1 metric to look at is the committed ARR (Annual Recurring Revenue) — its not revenue, but the annualized run rate of your revenue which is the revenue that has been committed to the business which makes a big difference. Even for fast growing SaaS companies, with a growth rate of more than 50% Y-O-Y, I will strongly recommend these companies to also track MRR and M-O-M growth rates.

The second metric to look at is how expensive it is to acquire every dollar which means knowing what is the lifetime value of a customer and what is the customer acquisition cost. A typical financial metric that most SaaS companies use is LTV by CAC or in some sense what is the payback of customer acquisition cost and keeping that metric high is pretty important because that really reflects the health of the margin, the churn and the payback for the SaaS company.

The third metric goes back to the Land and Expand field which is how much of the dollar you are starting to earn you can retain after 12 months. Many SaaS companies use net dollar retention which is the amount of revenue from the current customers that you can retain after including churns and also opposite of possibilities.”

As an investor, Kabir shared what (other factors) he looks at when he evaluates a SaaS company and also how he is looking at SaaS as an investment thesis.

“Going down to deeper levels, it is about how product/customer engagement is playing out to going a bit deeper than customers’ NPS (Net Promoter Score). We will also observe if the (SaaS) company has strong reference about customer for that is particularly important for large enterprise and a critical factor to help them scale. Also, the quality of customers is important because if you got high profile-type A customers, that makes a big difference and it makes it easier to sell further — think about selling to top pharma/FMCG/tech companies, it will really help the SaaS company to scale up in later stages.

Additionally, given where we are right now in this kind of COVID environment, we do spend a bit of time thinking about what sectors are (SaaS companies) customers in. There is both a vertical and horizontal cut — on the vertical cut, it is so much about understanding what your customers are going through. For example, if you are selling software to the airlines, oil & gas, brick & mortar retail, those are the sectors that are badly impaired and regardless of how good your product is, it is going to be difficult to sell. Versus, if you are selling into sectors that are doing still very well such as pharma, government or FMCG. Hence we do spend some time looking into the sector(s) SaaS companies are selling into. Also, the type of software is also very critical — are you a ‘pain medicine’ or ‘vitamin’? Especially in this environment, where we are in one of the worst recessions seen in the past 100 years, on the ground reality is that it is tough as IT/software budgets will be under pressure. Hence it is absolutely critical to assess if the product is a ‘pain medicine’ or ‘vitamin’.”

Kabir also shared what he has seen/observed that is working well and what is not for SaaS companies, especially in this part of the world (Asia-Pacific).

“We have seen how (SaaS) companies that have taken a Global First approach so you got strong development happening in Asia selling globally — That is kind of working well.

We are definitely at least seeing at least the quality of engineers, strong in some geography in particular, India and we have seen very strong talents emerging from parts of Asia, such as Vietnam. I think we will see the early onset of that happening and other parts but it needs to be developed. And so I think that is leading to several companies starting from APAC serving the globe and I think that is an interesting opportunity. I think we are seeing also entrepreneurs that are kind of maturing and also several second time entrepreneurs starting businesses. We also observed several patterns where you got one founder in your target market (could be the US, Europe), and one founder sitting in Asia and we see several of that happening. These are areas which we can really help at B Capital because we have a global footprint and helping companies think about scaling globally from a sales motion standpoint, from a customer standpoint, from even your development center standpoint, it is something we can be with you on your journey.”

The panelists also covered many interesting points and provided detailed insights such as the best practices for SaaS companies in gaining scale, the biggest challenges as Haryanto scaled his business and how Moka overcame those challenges, things that he might have done differently, his advice to fellow founders-especially those with businesses targeting micro merchants and SMEs, the impact of churn on SaaS companies and how can it can be reduced.

This webinar is definitely worth a watch.