After Decades of Focus on Technology Innovation, It’s Time for Climate Companies to Ask: “Can We Scale This?”

October 30, 2024

By: Jeff Johnson (General Partner & Head of Climate, B Capital), Vinay Shandal (Managing Director & Senior Partner, BCG), Parham Peiroo (Partner, BCG) and Mia Nixon (B Capital)

Climate technology companies seeking new and innovative ways to address the major challenges of the energy transition are critical. We often come across businesses using novel technologies to solve industry needs. However, at times we see management teams over-index their attention and investment on technical developments at the expense of commercial activities and focus. While technical developments are crucial, it is not the sole factor to ensure a scalable and successful business in today’s climate landscape.

Last year, the US Department of Energy (“DOE”) issued a new Adoption Readiness Level (“ARL”) Framework that we believe is useful to guide companies seeking to advance the energy transition.

Bringing New Technologies to Market: Historically Focused on Technical Maturity

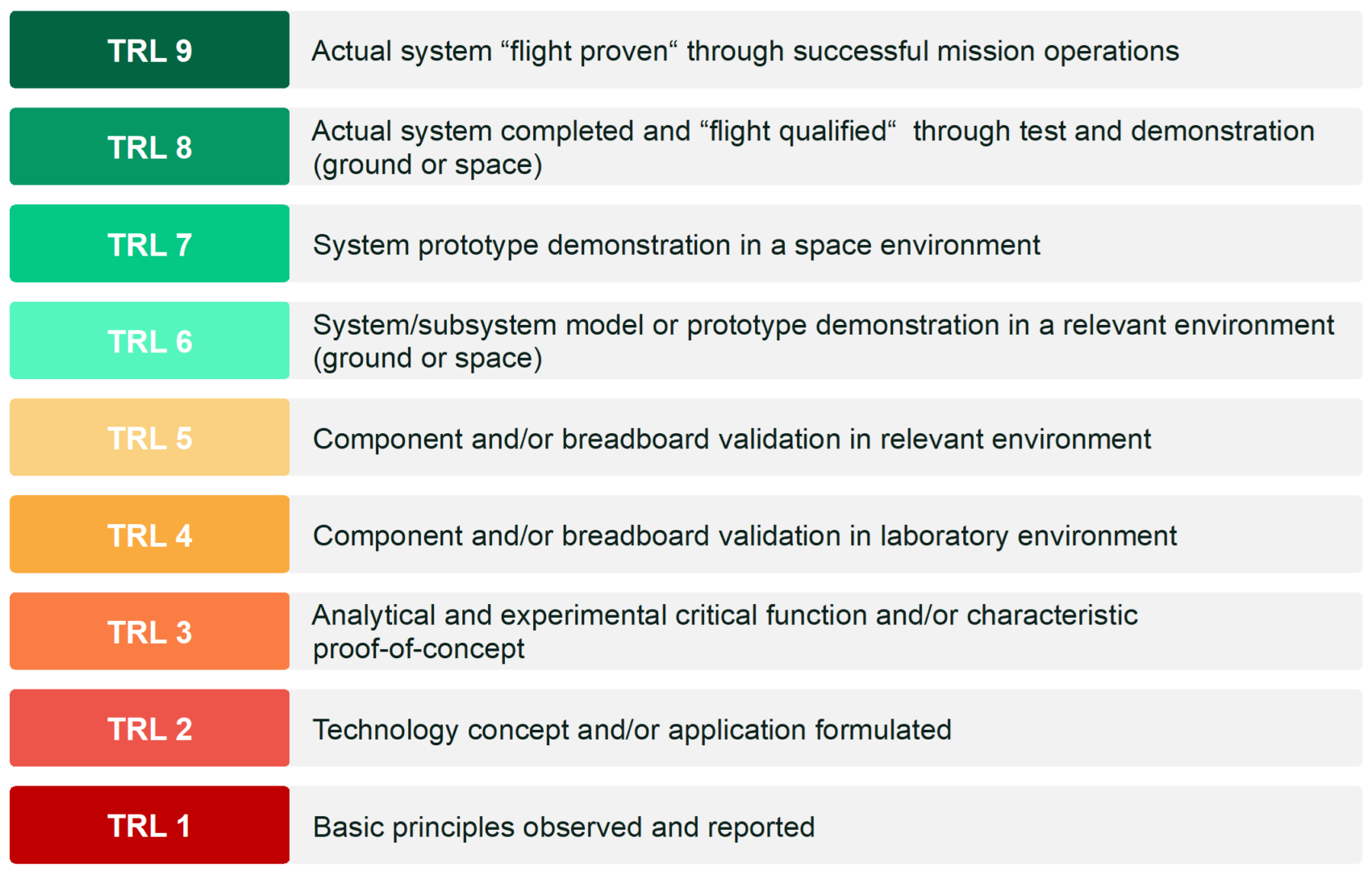

As we think about where the industry has been focused, the existing frameworks — including NASA’s Technology Readiness Level (“TRL”) — have led companies to prioritize investments in technical feasibility over all else. This acute focus made sense in the mid-1970s when TRL was first developed as a means to track industry progression on a shared goal of achieving space exploration. At that time, whether the technology could actually bring humanity to the moon, without regard for commercial tenability, was critical.

But this framework is often misapplied by industry practitioners (operators and investors) towards commercially oriented climate businesses. Often, technologies fail in commercialization not due to technical issues, but because economic and business considerations have not been adequately addressed. Factors like cost, resource availability, regulatory support and customer engagement are paramount in determining the viability of climate technologies in the market. We know these factors cannot be overlooked in assessing the long-term outlook for technologies.

The history of the climate tech sector gives us numerous examples of solutions that worked from a technical perspective but ultimately did not reach market success.

For example, the biofuels market was a very active area of investment in the first “CleanTech 1.0” wave from 2006-2012. These companies were all able to successfully produce fuels yet struggled with challenging unit economics, high capital intensity and low scalability. This resulted in many businesses missing cost and development targets before ultimately declaring bankruptcy. What we’ve learned from this is producing the fuel alone wasn’t impactful and numerous other factors — explicitly laid out in the ARLs — needed to be addressed.

Technology Readiness Levels

Technology Readiness Levels (NASA, (2023.) Technology Readiness Levels (TRLs). Earth Science and Technology Office.)

Moving from “Can we build it?” to “Can we build AND scale it?”

Unlike the TRL, the ARL framework addresses how ready a technology is for market adoption and considers factors beyond technical maturity. DOE’s Office of Technology Transition (“OTT”) created ARLs in response to a broader shift in the agency—moving from an R&D organization focused on maturing technology to one that demonstrated and deployed technology to achieve commercial liftoff. After reviewing other ‘readiness levels’ that emerged to accompany TRL, DOE OTT developed ARLs to articulate the full set of adoption barriers that new companies, technologies and emerging sectors face.

Adoption Readiness Levels

Adoption Readiness Levels (U.S. Department of Energy. Adoption Readiness Levels (ARL) Framework. Office of Technology Transitions, 2023.)

The framework was designed to both educate technologists on the adoption barriers faced by technology as it moves towards deployment and serve as a common language between technologists and those seeking to finance or deploy technology.

By systematically identifying these barriers earlier, they can be overcome as the technology matures versus when it’s too late.

The ARL framework specifies the assessment of 17 specific dimensions that contribute to technology adoption risks across four key buckets—value proposition, market acceptance, resource maturity and license to operate. The figure below provides a concise summary of these dimensions:

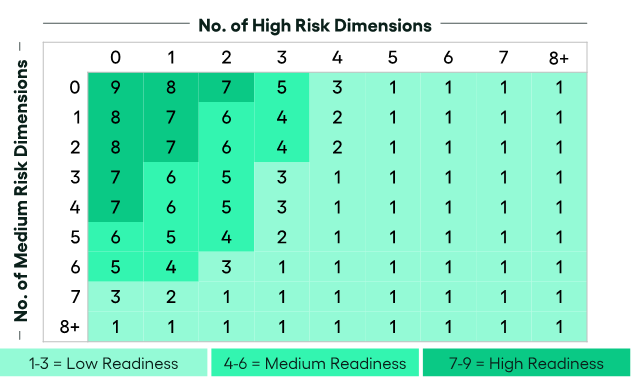

To assess a technology, each of these dimensions is graded as having low, medium or high risk based on well-articulated standards as defined in the US DOE Commercial Adoption Readiness Assessment Tool (“CARAT”). The overall ARL score focuses on the number of medium- and high-risk factors identified in the assessment. The matrix below provides the framework to determine the final ranking:

Commercial Adoption Readiness Assessment Tool

Commercial Adoption Readiness Assessment Tool (Tian, Lucia, Jacob Mees, Vanessa Chan, and William Dean. Commercial Adoption Readiness Assessment Tool (CARAT). U.S. Department of Energy, Office of Technology Transitions, 2023.)

The CARAT framework’s low, medium or high risk classifications are based on specific criteria designed to help both climate tech companies and investors pinpoint commercial barriers early and take action.

- Low Risk: A dimension is considered low risk when clear pathways exist for the technology to be adopted with minimal barriers. For example, in the capital flow dimension, low risk could mean that institutional investors have already validated the technology’s return profile and regular investment processes are well established. Similarly, a technology might score low risk in the market acceptance dimension if it has a compelling value proposition that meets market needs and is positioned for broad scalability with minimal additional effort. Technologies with established markets, secure capital and straightforward regulatory pathways typically fall into this category.

- Medium Risk: Medium risk dimensions represent areas where some barriers exist, but they are manageable with strategic intervention. For instance, a technology might score medium risk in the resource maturity dimension if critical resources are available but there are potential supply chain constraints that need to be addressed for full-scale deployment. Similarly, if a technology’s project development capabilities are somewhat established but unproven on a large scale, it would also be classified as medium risk. In these cases, although challenges exist, there is a clear path forward with targeted investments or partnerships.

- High Risk: High risk dimensions indicate significant barriers that must be overcome for successful adoption. In the license to operate dimension, for example, a high risk score might be given if substantial regulatory or social hurdles exist, such as the need for new legislation or widespread community opposition. Similarly, a high risk in manufacturing and supply chain could point to the absence of necessary infrastructure, meaning the technology would require significant new development or overhaul of existing systems. Technologies facing high risks may need substantial additional time, capital and innovation to address these barriers.

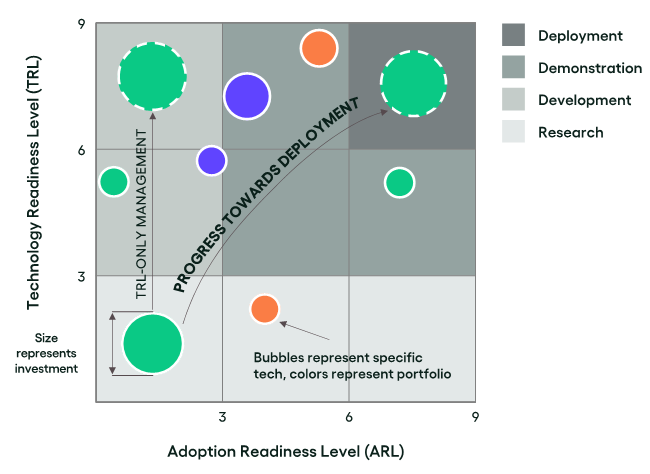

In our view, it is important that our industry moves away from today’s TRL-focused management approach and broaden it to concurrently manage commercial development. The figure below illustrates this approach:

Progress Toward Deployment

Copyright © 2023 by Boston Consulting Group. All rights reserved.

(Tian, Lucia, Jacob Mees, Vanessa Chan, and William Dean. Commercial Adoption Readiness Assessment Tool (CARAT). U.S. Department of Energy, Office of Technology Transitions, 2023.)

While still in the early days of use, DOE is successfully leveraging ARLs to plan investments, make those investments and then ensure those investments are successful. Multiple teams across the DOE’s research, development, demonstration and deployment (“RDD&D”) continuum use ARLs to plan near- and long-term sectoral strategy through Liftoff Reports and the Decadal Fusion strategy. ARLs also support researchers across DOE’s 17 National Labs as they commercialize their technology in the Energy I-Corps Program. Additionally, the framework is being used to assess risk across the tens of billions of dollars in large scale demonstration and deployment projects funded by the Bipartisan Infrastructure Law and Inflation Reduction Act.

The ARL framework is more than a tool to understand how the DOE plans investments; it is an opportunity for both companies and investors to better manage risks, prioritize technologies that are most likely to positively impact the energy transition and build business plans that bring critical attention to deployment challenges. While the concept of the ARL framework may be novel, many leading climate tech companies have built similar types of thinking into their business strategy — which has served as a foundation for their commercial success. One such example is BioCirc.

Case Study: BioCirc’s Strategy to Ensure Market Adoption and Scalability

Founded in 2021, BioCirc develops, owns and operates integrated energy clusters that combine biomethane plants with solar and wind assets, and has rapidly grown to become the world’s second-largest biogas producer in just three years. A linchpin to its success story has been an adaptable business model featuring reliable and cost-competitive green energy, brought to market alongside strategic partners (e.g., municipalities, farmers and landowners) where there have been meaningful economic incentive alignment, setting the foundations for both resource security and a strong license to operate. In doing so, BioCirc’s strategy intrinsically contemplated many of the key themes embedded in the ARL framework: value proposition, market acceptance, resource maturity and license to operate.

Value Proposition

BioCirc’s business strategy benefits from a decentralized solution built on the foundations of known, renewable energy technologies (e.g., solar, wind, biogas). Not only does the novel integration of these technologies help de-risk the business, but it also generates green energy at a material discount relative to traditional systems without such integration. Additionally, this modulated approach allows BioCirc to flexibly shift its go-to-market approach based on market signals. For example, if power prices drop, it can put emphasis on Power-to-X, whereas if prices increase, it can home in on selling power directly to the grid. This adaptability gives BioCirc a unique value proposition that enables it to sustain operations and profitability under fluctuating market conditions.

Market Acceptance, Resource Maturity and License to Operate

Early on, BioCirc recognized that successful commercial deployment necessitates ecosystem engagement. As such, it built a partnership model that prioritizes local relationships, including farmers, landowners and local governments — making them key partners in the venture. Doing so has allowed the company to secure feedstock, skilled talent and a supportive permitting environment — as well as a broader license to operate and scale its offering. These partnerships were built through meaningful engagement, listening, creating true economic incentive alignment and demonstrating a local-first mindset in each new market it has entered.

Lessons Learned for Investors and Operators

BioCirc’s comprehensive business strategy shows how other operators should consider road-mapping growth plans, and creates some key lessons for both investors and operators alike:

- For Investors:

- Assess how well a company brings time and attention not just to technology development but commercial deployment.

- Look at how the company is building a unique value proposition for each of their stakeholders, developing pricing or other economic incentives that can generate commercial tenability.

- Evaluate the ease with which the technology can be deployed or projects developed (including value chain integration).

- Where challenges or risks persist (as will be the case with many climate technologies), consider how the company is thinking about mitigating or retiring those risks.

These considerations are essential for underwriting a commercially viable and scalable investment.

- For Operators:

- Proactively consider the full gamut of ARL dimensions in your business strategy with a real emphasis on commercial deployment.

- Consider and articulate a plan around how your offering is uniquely distinctive in the market (e.g., cost competitive, premier performance, ease of use).

- Develop a clear-eyed perspective on how your projects will be developed or integrated into the value chain as well as an identification of the full spectrum of risks associated with early deployments (e.g., financial profile, system integration, permitting) and the corresponding risk-rating.

- Build and carry out an authentic stakeholder engagement strategy being ever mindful of the risks and benefits to communities impacted by your solution.

- Bring early attention to regulatory standards that must be met, which may serve as a tailwind, or potential challenge, to your solution.

BioCirc’s business strategy and roadmap looked well beyond technology readiness and honed in on commercial adoption, weaving in various considerations that the DOE has highlighted in its ARL framework. The ARL framework provides the right building blocks for other innovators to consider as they design a cohesive business strategy, and for investors as they evaluate and underwrite such technologies.

The Results: Greater Outcomes Through Smarter Investment

Taking this view on commercial deployment will allow the new “Climate 3.0” era — to benefit from lessons learned during “Clean Tech 1.0” and “Climate Tech 2.0” while ushering in more success stories and swifter climate action.

We believe the critical linchpin here is a renewed focus on commercialization for startups in the space. We are seeing scaling companies, and their ecosystem partners do this successfully across multiple industries. For example, automotive companies are signing contracts with innovative companies historically viewed as high risk to allow them to raise private capital to build out their production facilities. In addition more companies are minimizing capital requirements by moving away from the historical practice of vertical integration to focus development on core capabilities to minimize capital requirements.

Building sustainable, profitable climate tech businesses at scale is the key to maximizing climate outcomes and the ARL framework is a powerful tool for evaluating their commercial tenability and scalability. B Capital Climate generally uses ARLs as part of its initial assessment of companies to determine whether it will initiate deeper due diligence on an opportunity. B Capital also typically uses the framework in its diligence efforts to ensure it has a full picture of the factors required for successfully “crossing the chasm” from development to deployment.

We encourage investors and entrepreneurs alike to use ARLs to identify any potential gaps in company business plans and to ensure proposed technologies can efficiently move from the testing lab and into the world. Taking this measured approach will bring greater alignment and a common understanding of how to pursue success for what it takes to set the technology up for success in making a notable and sustainable impact in today’s Climate 3.0 landscape.

References

For further reading, see the complete US DOE ARL assessment description here.

Acknowledgments

The authors would like to thank Julius Goldberg-Lewis and Dr. Vanessa Z Chan, from the DOE Office of Technology Transitions, and Mads Peter Langhorn and Morten Lybaek, from BCG, for their invaluable insights and contributions to this article.

LEGAL DISCLAIMER

All information is as of 10.28.2024 and subject to change. Certain statements reflected herein reflect the subjective opinions and views of B Capital personnel. Such statements cannot be independently verified and are subject to change. Reference to third-party firms or businesses does not imply affiliation with or endorsement by such firms or businesses. It should not be assumed that any investments or companies identified and discussed herein were or will be profitable. Past performance is not indicative of future results. The information herein does not constitute or form part of an offer to issue or sell, or a solicitation of an offer to subscribe or buy, any securities or other financial instruments, nor does it constitute a financial promotion, investment advice or an inducement or incitement to participate in any product, offering or investment. Much of the relevant information is derived directly from various sources which B Capital believes to be reliable, but without independent verification. This information is provided for reference only and the companies described herein may not be representative of all relevant companies or B Capital investments. You should not rely upon this information to form the definitive basis for any decision, contract, commitment or action.