Finding and Funding the Next Frontier of Climate Investments in India

September 18, 2024

This blog is the first in a three-part series exploring our perspective on climate tech investments in India. In the next two installments, we will delve into the most promising opportunities over the next 18-24 months and provide in-depth analyses of select sectors.

By: Karan Mohla, General Partner & Deepanshu Pattanayak, Principal, B Capital

Climate change is accelerating at an alarming rate, with global temperatures projected to rise by 2.5°C[1] by the end of the century without immediate and drastic action. Emerging markets, despite contributing less to global emissions, face disproportionate risks from climate change’s devastating effects, including extreme weather events, food insecurity and economic instability.

Recent years have seen a long-overdue increase in attention from world leaders and corporations to address this imbalance. At COP28, a significant step was taken with a $13 billion pledge[2] to aid developing countries in managing climate-related disasters. Additionally, the UN has launched a critical $3 billion initiative to implement advanced early warning systems for climate-related events[3]. The goal is to provide these systems to every person on Earth within the next five years. This program is vital for vulnerable communities to prepare for and adapt to the increasing frequency and severity of extreme weather events and natural disasters.

However, these efforts, while important, are merely a drop in the ocean compared to what’s truly needed. To meet our low-carbon goals and avert catastrophic climate change, we require an additional $5 trillion[4] in annual investments by 2030. This funding must not only scale existing solutions but also drive the development and implementation of groundbreaking innovations, particularly those tailored to the regions hardest hit—emerging countries. The urgency of this situation cannot be overstated: every year of delay exponentially increases the cost and difficulty of mitigating the worst effects of climate change.

Climate Tech Funding Trends in India

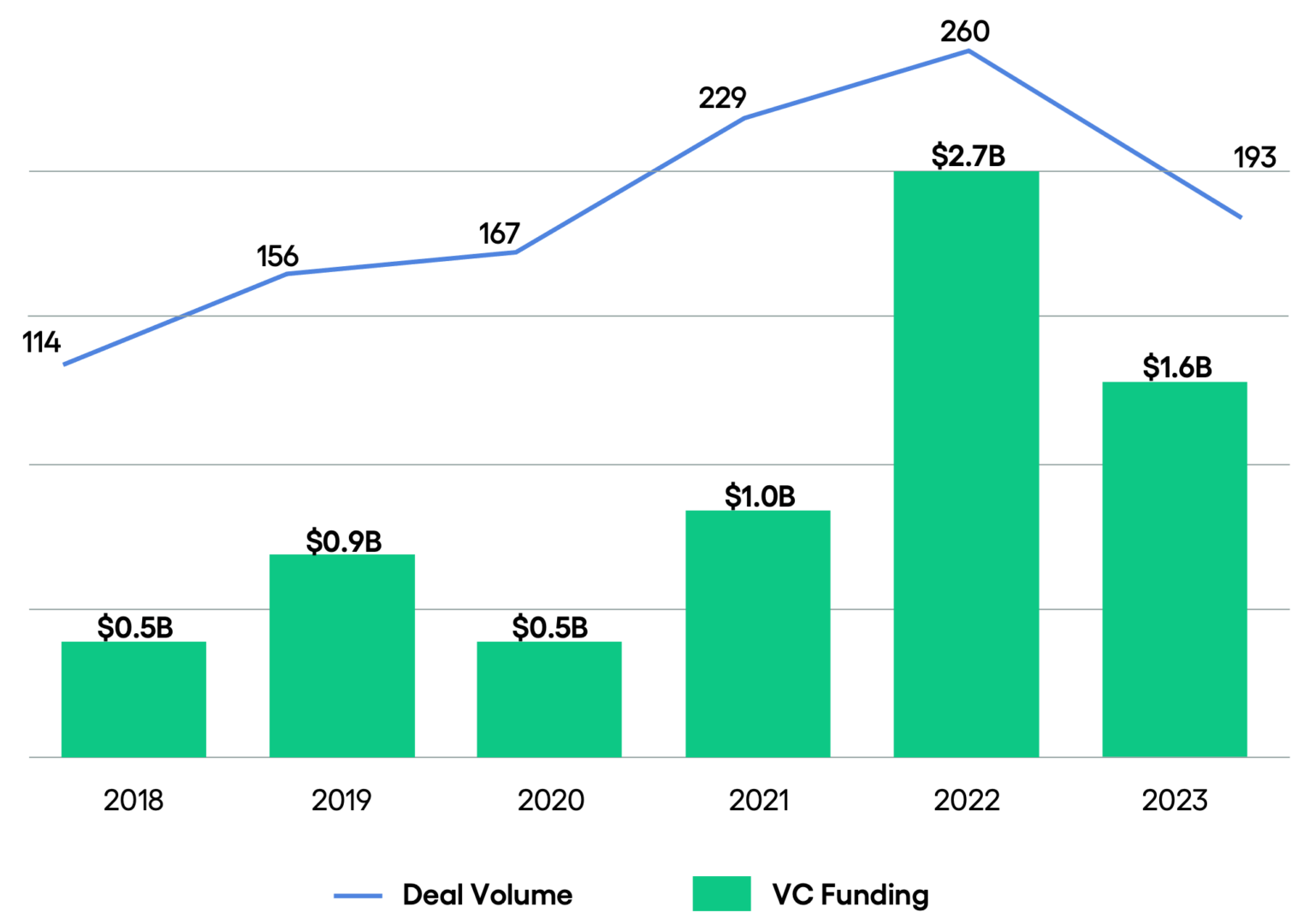

The growth of climate startups in India is the direct result of the influx of venture capital from both domestic and global investors. Between 2018 and 2023, climate tech startups in India received a total of $7.2 billion[5] in VC funding.

VC Funding for Climate

Approximately 55-60% of this funding has been allocated to the EV OEM and enablement sectors, including battery technology, charging infrastructure, and financing. In contrast, mobility solutions, such as Blusmart—a company offering an EV fleet for cab rides—have received around 15-20% of the total funding.

Source: Tracxn

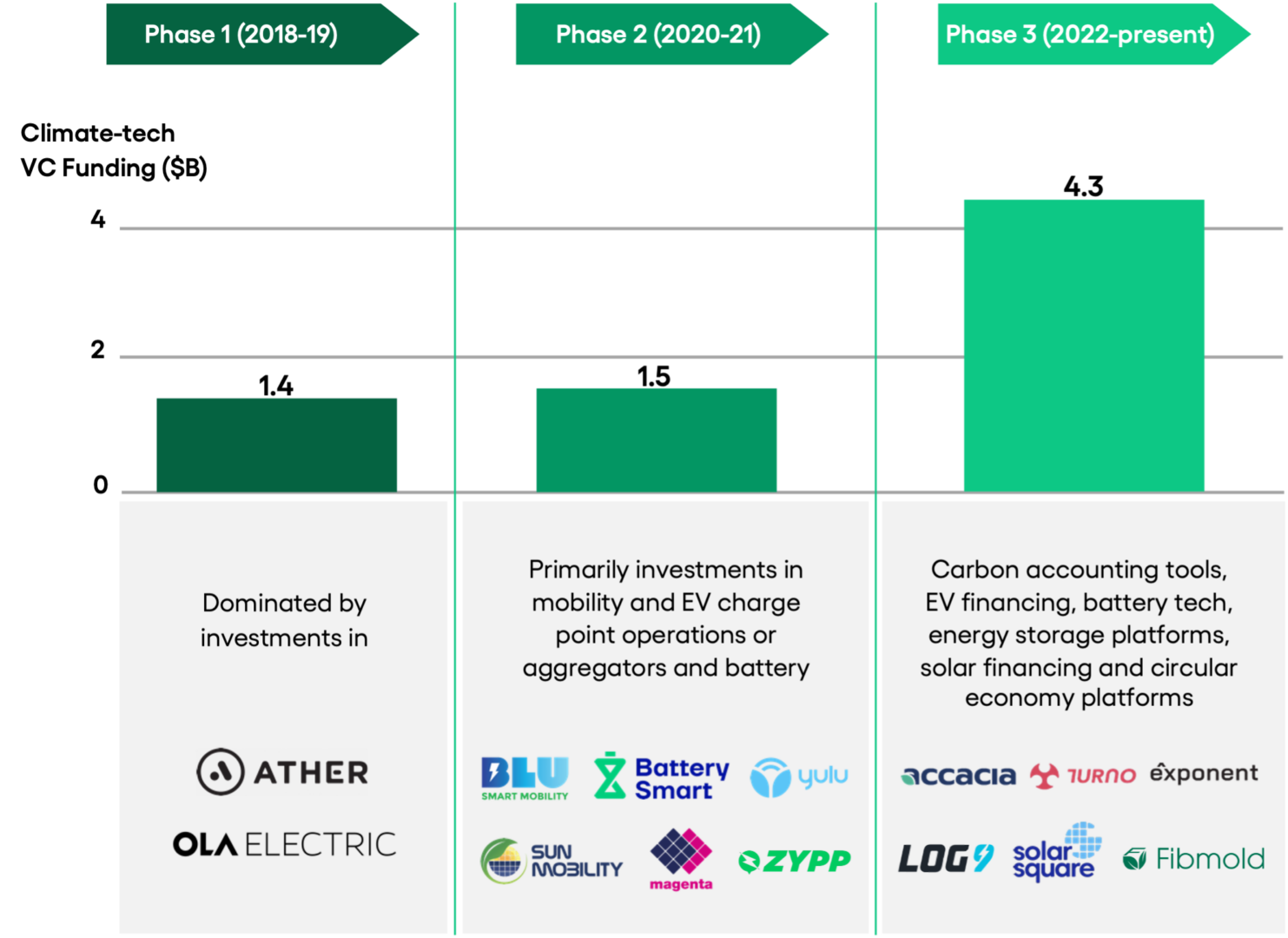

India’s climate tech story can be divided into three key phases:

- Phase 1 was predominantly about rise of new age EV OEMs like Ather and Ola

- In Phase 2, we saw a rise of mobility and EV charge point operators or aggregators and battery swapping players (including Blusmart, Battery smart, Yulu and Zypp).

- In Phase 3, the more recent developments have been in areas like carbon accounting tools, EV financing, battery tech, energy storage platforms, solar financing and circular economy platforms.

We estimate that about $2B+ of dedicated dry powder is available for climate tech investments in India across climate focused funds, domestic tier 1 investors and

global VCs.

Factors Fueling Climate Funding Growth in India

1. Government Policy

India is the third-largest CO2 emitter, responsible for 8%[6] of global energy emissions, and one of the most vulnerable countries to weather-related losses and climate risks. To meet its climate goals, India will need to scale up its annual climate investments from $18 billion per year to $170 billion per year in 2030[7]. Achieving this will demand significant collaboration between policymakers, corporations and consumers.

Recognizing this, India’s policymakers have announced robust climate policies and declared over $20 billion in subsidies and grants to incentivize the adoption of clean-tech solutions.

Notable initiatives include:

- FAME-II and FAME-III Subsidies: $1.3 billion was allocated between 2019 and 2024[8] under the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME-II) subsidy to accelerate electric vehicle adoption, with an additional $300 million[9] outlay announced for FY25.

- PM Surya Ghar Muft Bijli Yojana: This initiative supports rooftop solar installation in low-income households, with approximately $9 billion allocated from 2023 to 2027 to increase rooftop solar penetration.

- Production Linked Incentives (PLIs): To boost local manufacturing, $2.3 billion[10] has been allocated for solar panel production, and $2.1 billion[11] for advanced cell chemistry and battery storage.

- National Green Hydrogen Mission: $2.3 billion[12] has been earmarked from 2023 to 2030 to support the production, use and export of green hydrogen and its derivatives.

- PM-eBus Sewa Scheme: $2.5 billion will be allocated to 169 cities[13] under this scheme, aiming to deploy 10,000 electric buses through public-private partnerships to promote green urban mobility.

2. Key climate-related trends in India

In India, higher adoption rates among corporates and consumers are driving the transition toward greener alternatives. This includes significant investments by corporates in clean mobility, renewable energy capacity, energy management solutions, sustainable materials and improved emissions reporting. Consumers are also increasingly favoring green solutions such as electric vehicles, solar energy, etc. as their overall cost of ownership is lower vs more traditional alternatives.

All of this has resulted in the five key trends noted below:

- Rapid growth of electric vehicle adoption in India: Between 2019 and 2023, two-wheeler EV sales surged approximately 30-fold to over 850,000 units, achieving 5% market penetration[14], while three-wheeler EV sales increased around 75-fold to 75,000 units, reaching 12% market penetration[14]. This growth has been fueled by significant OEM investments in product improvements, a global decline in battery prices and supportive government subsidies that have lowered the total cost of ownership for EVs below that of internal combustion engine vehicles. Projections suggest that EVs will account for 40% of the market by 2030, up from 5% in 2023[15].

- Rise of fast-charging solutions: Fast-charging solutions have benefitted from the increasing use of LFP (Lithium Iron Phosphate) cells, which are better suited for rapid charging compared to NMC (Nickel Manganese Cobalt) cells due to their higher heat tolerance, longer charging cycles and 30%-40% lower cost[16]. Innovations in battery pack technology and software have also significantly improved thermal management and charging speeds. The government is playing a crucial role in developing the fast-charging infrastructure, with over $100 million[17] allocated in subsidies for the installation of approximately 7,000 fast chargers specifically along highways across India.

- Higher adoption of urban green mobility solutions: Dedicated electric fleets are emerging in India, gaining traction among consumers. For example, Blusmart has built a fleet of 7,000 EVs since its inception in 2019[18] and delivered over 7.5 million trips in 2023 alone, a significant increase from its life-time total of 2.5 million trips through 2022[19]. Several state transport corporations, including those in Delhi, Mumbai and Bangalore, are also advancing efforts to electrify their intracity bus fleets. Additionally, fleet electrification is accelerating among corporates, with major companies such as Flipkart, Myntra, Ikea, BigBasket and Zomato committing to a 90%+ EV transition by 2030[20].

- Increase in rooftop solar installation: Rooftop solar adoption in India has surged sixfold since 2018, reaching ~12 GW[21] of installed capacity. This growth is driven by increased consumer demand, supportive policy announcements, government subsidies, falling solar module prices and improved financing options. Recent policy tailwinds such as [PM Surya Ghar Muft Bijli Yojana] is expected to generate 25 to 30 GW of rooftop solar installation opportunities over the next two to three years[22] and aims to facilitate this by providing financial assistance through capital subsidies and granting up to 300 units of free electricity every month[23] to ~10M households across India.

At B Capital, we are thrilled by the immense potential of climate sector opportunities in India and believe that the climate investment landscape is at a critical inflection point. We are committed to leading this vital transition and are eager to support the next wave of climate tech startups emerging from India. If you’re building in this space, we’d love to hear from you at info@b.capital.

LEGAL DISCLAIMER

Certain statements reflected herein reflect the subjective opinions and views of B Capital personnel. Such statements cannot be independently verified and are subject to change. Reference to third-party firms or businesses does not imply affiliation with or endorsement by such firms or businesses. The information herein does not constitute or form part of an offer to issue or sell, or a solicitation of an offer to subscribe or buy, any securities or other financial instruments, nor does it constitute a financial promotion, investment advice or an inducement or incitement to participate in any product, offering or investment. Much of the relevant information is derived directly from various sources which B Capital believes to be reliable, but without independent verification. This information is provided for reference only and the companies described herein may not be representative of all relevant companies. You should not rely upon this information to form the definitive basis for any decision, contract, commitment or action.

SOURCES

[1] https://www.unep.org/resources/emissions-gap-report-2023

[2] https://unfccc.int/cop28/5-key-takeaways#strengthening-resilience

[3] https://www.un.org/en/climatechange/early-warnings-for-all

[4] https://www.imf.org/en/Blogs/Articles/2023/11/27/world-needs-more-policy-ambition-private-funds-and-innovation-to-meet-climate-goals

[5] Traxcn research

[6] https://ourworldindata.org/co2-emissions

[7] https://www.ifc.org/content/dam/ifc/doc/2023/Report-Blended-Finance-for-Climate-Investments-in-India.pdf

[8] https://pib.gov.in/PressReleaseIframePage.aspx?PRID=2004594

[9] https://economictimes.indiatimes.com/industry/renewables/budget-2024-unlikely-to-announce-fame-iii-scheme-says-hd kumaraswamy/articleshow/111778599.cms?from=mdr

[10] https://pib.gov.in/PressReleaseIframePage.aspx?PRID=1911380

[11] https://heavyindustries.gov.in/pli-scheme-national-programme-advanced-chemistry-cell-acc-battery-storage

[12] https://mnre.gov.in/national-green-hydrogen-mission/

[13] https://pib.gov.in/PressReleaseIframePage.aspx?PRID=1949430

[14] https://vahan.parivahan.gov.in/vahan4dashboard/vahan/view/reportview.xhtml

[15] https://www.bain.com/globalassets/noindex/2023/bain_report_india_electric_vehicle_report_2023.pdf

[16] https://about.bnef.com/blog/lithium-ion-battery-pack-prices-hit-record-low-of-139-kwh/

[17] https://pib.gov.in/Pressreleaseshare.aspx?PRID=1911394

[18] https://www.livemint.com/auto-news/electric-cab-blusmart-ola-uber 11723546679815.html#:~:text=From%20just%2070%20cabs%20in,separate%20b usinesses%20for%20the%20firm.

[19] https://auto.economictimes.indiatimes.com/news/aftermarket/blusmart-fleet-completes-10-million-all-electric-rides/105442998

[20] https://www.wbcsd.org/wp-content/uploads/2023/10/Advancing-electrification-of-e-commerce-deliveries-in-India-A-Flipkart-case-study-.pdf

[21] https://www.mercomindia.com/india-rooftop-solar-1h-2024

[22] https://www.pib.gov.in/PressNoteDetails.aspx?NoteId=152016&ModuleId=3

[23] https://www.thehindu.com/business/budget/budget-2024-nirmala-sitharaman-free-electricity-rooftop-solar-programme-crore/article67799542.ece