By: Jeff Johnson and Karly Wentz

In our last piece, we introduced Climate 3.0—our term for a more disciplined, market-driven era of climate technology, focused on scalable, capital-efficient businesses with strong fundamentals. We also acknowledged a tough reality: many climate startups—particularly in the West—have relied on policies and incentives that have become inconsistent, unclear or even unavailable. The ground can feel unstable, and voluntary efforts alone won’t build lasting change.

So, the real question is: What kind of foundation can stand the test of time?

Here at B Capital, we believe the answer is Resilience Tech.

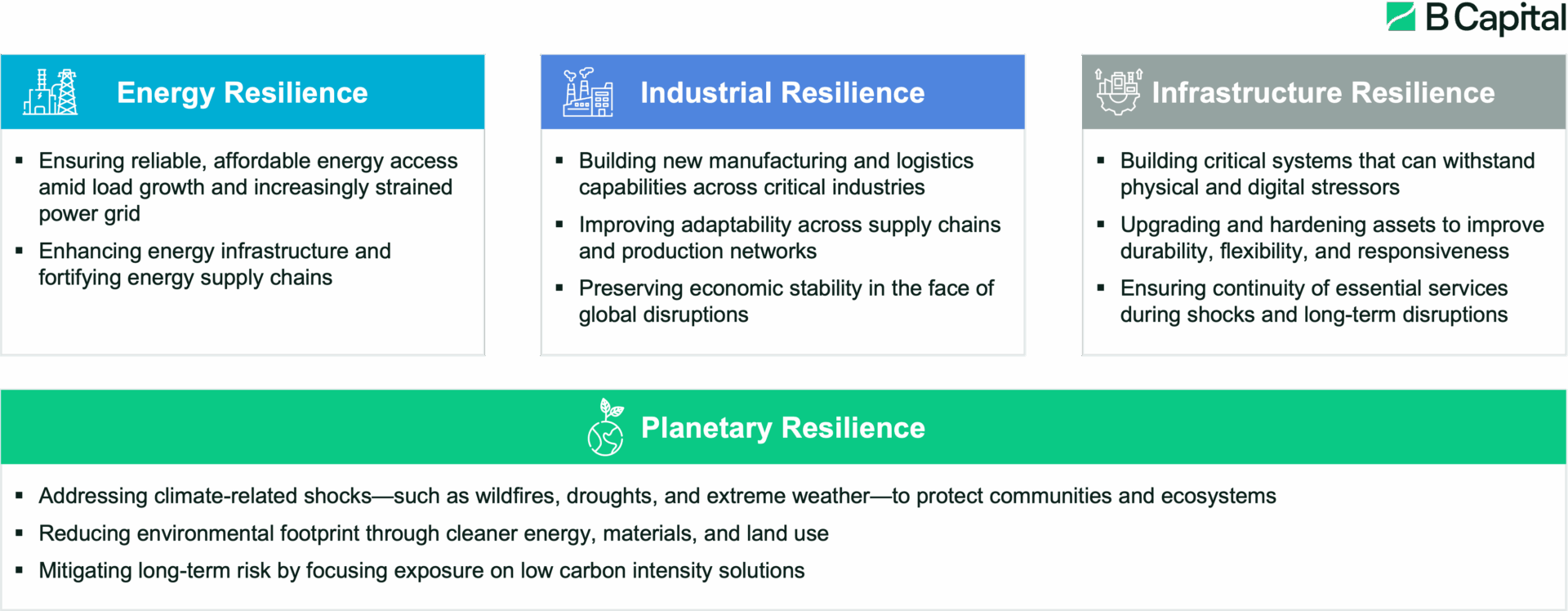

Resilience Tech is a refined lens on climate tech, highlighting solutions that strengthen energy, industrial, and infrastructure systems. It includes the tools, infrastructure and platforms that help people, businesses and governments adapt to a changing world—from climate shocks and energy volatility to food insecurity and fragile supply chains. These are the solutions that mitigate systemic risk while creating real economic value and remaining focused on planetary boundaries. Importantly, unlike many traditional climate technologies, Resilience Tech does not depend on incentives or policy mandates. It’s driven by urgent, market-based demand and built to scale on commercial fundamentals. Resilience Tech is underpinned by significant macro trends that we believe will create a ripe landscape for creating generation defining companies over the next decade.

In this article, we define Resilience Tech, highlight the core sectors we’re focused on and explore the structural megatrends shaping long-term demand for resilient systems.

What is Resilience Tech?

At its core, Resilience Tech is about building the systems that help societies withstand disruption—whether from climate shocks, geopolitical instability or surging energy demand. We define this emerging category across three interconnected pillars: Energy Resilience, Industrial Resilience and Infrastructure Resilience.

These pillars are deeply interconnected. Together, they form the foundation of a more resilient global economy—one designed to absorb volatility while driving sustainable growth.

Core Investment Themes

We believe the next wave of category-defining companies will emerge at their convergence, fueled by structural megatrends that are creating profound and enduring opportunities.

- Energy Resilience: Powering the Future

The rise of AI—and the electrification of buildings, transport and industry—is driving unprecedented electricity demand. Legacy infrastructure can’t keep up. We’re focusing on technologies that enable a more resilient, distributed and intelligent energy system built for the loads of tomorrow. - Industrial Resilience: Rebuilding the Global Supply Chain

Geopolitical fragmentation and economic nationalism are reshaping how goods are made and moved. From revolutionary products to flexible manufacturing to logistics platforms enabling reshoring and regionalization, we’re backing solutions that make industry more responsive, secure, and self-reliant. A key enabler of this shift will be Physical AI, catalyzing the next wave of automation, precision, and adaptability across the supply chain. - Infrastructure Resilience: Adapting to a New Reality

Extreme weather events—floods, wildfires, droughts and heat waves—are no longer future risks. They’re today’s reality. We support technologies that help communities adapt and recover in real time, from predictive climate analytics to systems that safeguard critical infrastructure.

Underpinning all three is a broader principle we call Planetary Resilience: the imperative to proactively manage environmental issues at scale, not just for impact, but for long-term stability and risk management.

In each of these domains, Resilience Tech sits at the intersection of urgent need and investable opportunity. It’s not a niche. We believe it’s the next frontier of essential technology, with significant macro tailwinds that drive a substantial portion of the global economy. The companies building it aren’t just solving problems—they’re designing the systems that will define a more stable, future-ready world.

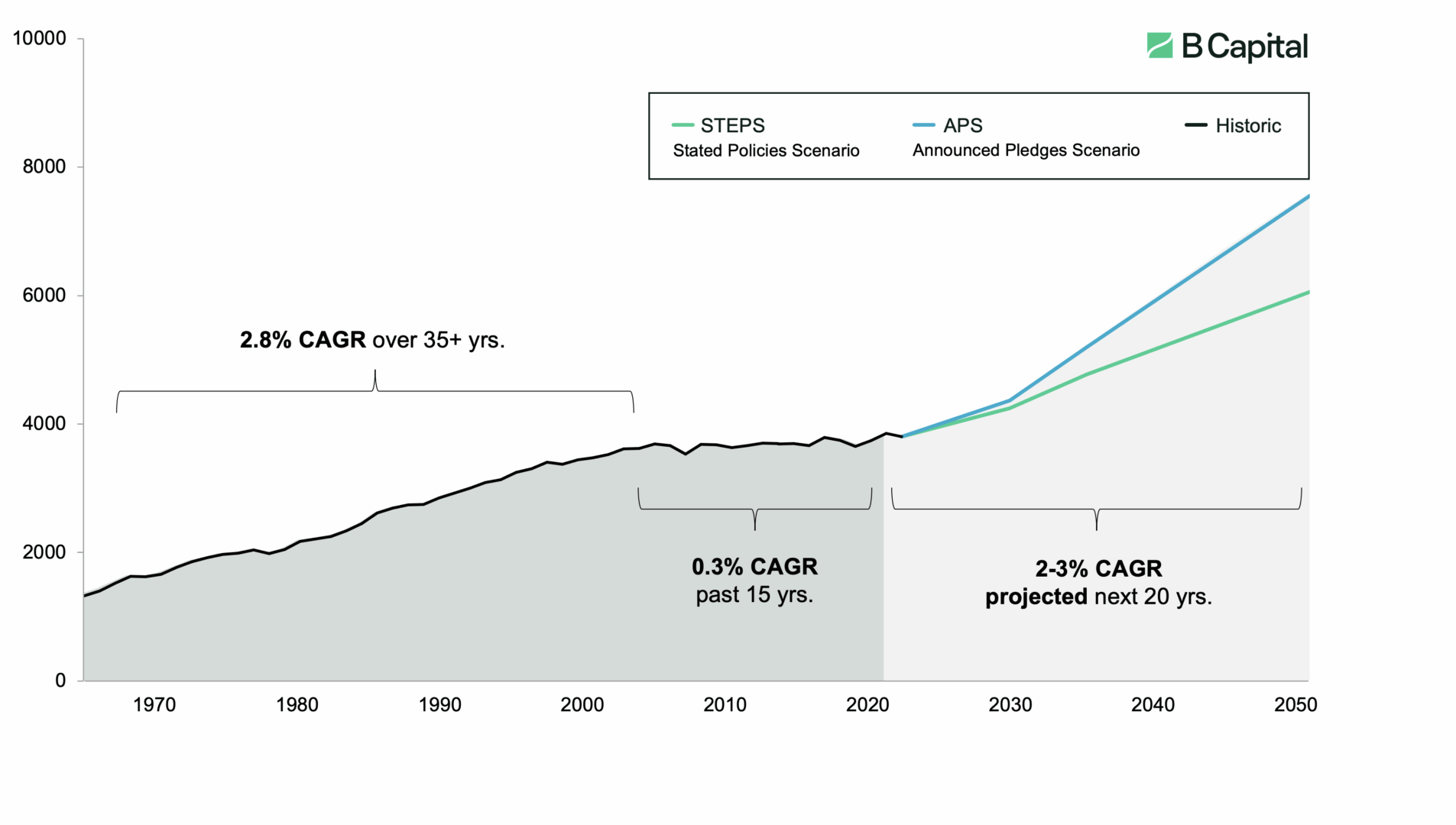

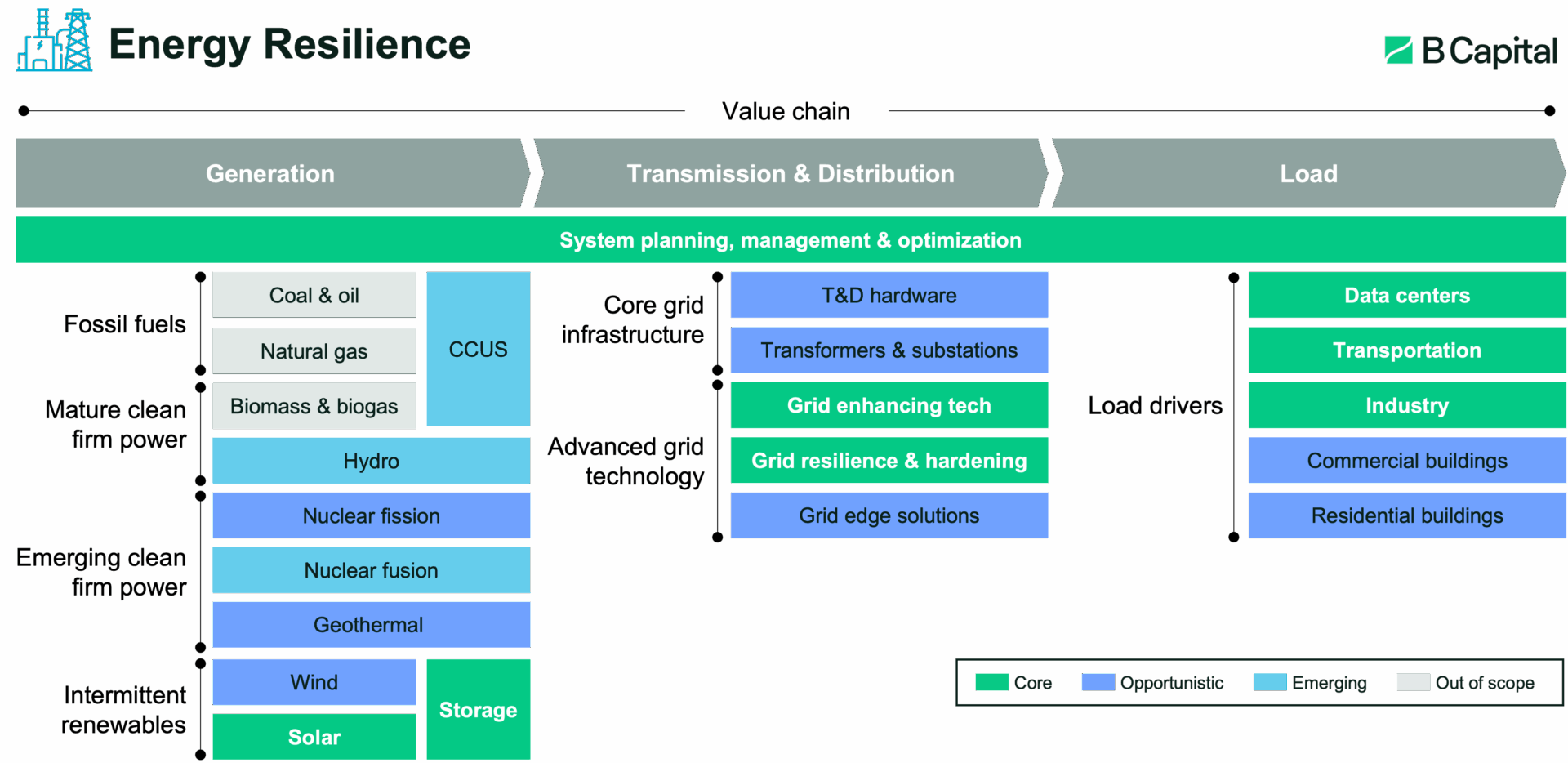

I. Energy Resilience: Powering the Future

For the first time in a generation, electricity demand is structurally rising in the US. From 2008 to 2020, U.S. power consumption remained mostly flat—even as the economy and population grew—thanks to gains in energy efficiency. 1 It appears that era is over. 2

Resurgence in Electricity Demand Growth

AI and electrification of industry, transportation and buildings driving acceleration in power demand

US Electricity Demand (TWh)3

A new wave of demand is being driven by the combined forces of AI adoption, industrial reshoring and broader electrification across sectors. Global electricity demand is projected to grow by 2-3% annually through 2027, with data centers forecasted to double their electricity consumption this decade.4 At the same time, the shift to electrify buildings, manufacturing and transport is placing unprecedented strain on outdated grid infrastructure.

We see this as one of the most powerful—and potentially profitable—shifts in the economy.

Where We’re Focused: 5

- Enabling renewables and storage: Technologies enabling cleaner, faster and more reliable energy deployment

Renewables—especially solar—are now the lowest-cost and quickest-to-deploy sources of electricity. While module costs continue to fall, soft costs such as installation, financing, permitting and operations now make up a growing share of total project expenses, creating opportunities to improve economics through software and services. Energy storage solutions, particularly batteries, are essential to managing the intermittency of renewables and are becoming increasingly cost-competitive. Policy shifts are reshaping the market in real time in the United States, but the strong underlying economics of these solutions are likely to remain attractive globally for the long term. This theme is reflected in B Capital portfolio companies like LevelTen, a marketplace for energy transactions, and Omnidian, a provider of performance and protection services for distributed energy systems. - Grid congestion solutions: Software and hardware innovations increasing grid flexibility and resilience by enhancing transmission capacity, optimizing load management and improving overall utilization

As electricity demand accelerates, technologies that improve grid efficiency have become essential. The U.S. grid must expand transmission capacity by more than 60% by 2035 to meet projected demand6. Once dismissed as “solutions in search of a problem,” smart grid technologies are now being rapidly adopted to relieve today’s constraints—boosting performance, improving reliability and lowering system-level costs. The most successful businesses not only tackle the technical challenges but also overcome business model barriers, ensuring their solutions align with how utilities and grid operators operate and generate revenue. - High-impact energy efficiency: Products that reduce energy intensity in critical load centers—such as data centers, factories and commercial buildings—are becoming essential

Efficiency now directly impacts grid reliability. As each marginal electron grows more valuable, demand is rising for solutions that lower power consumption without compromising performance. This isn’t just about decarbonization; it’s about keeping pace with accelerating demand. Companies that solve these challenges will benefit from durable tailwinds, regardless of shifts in climate policy.

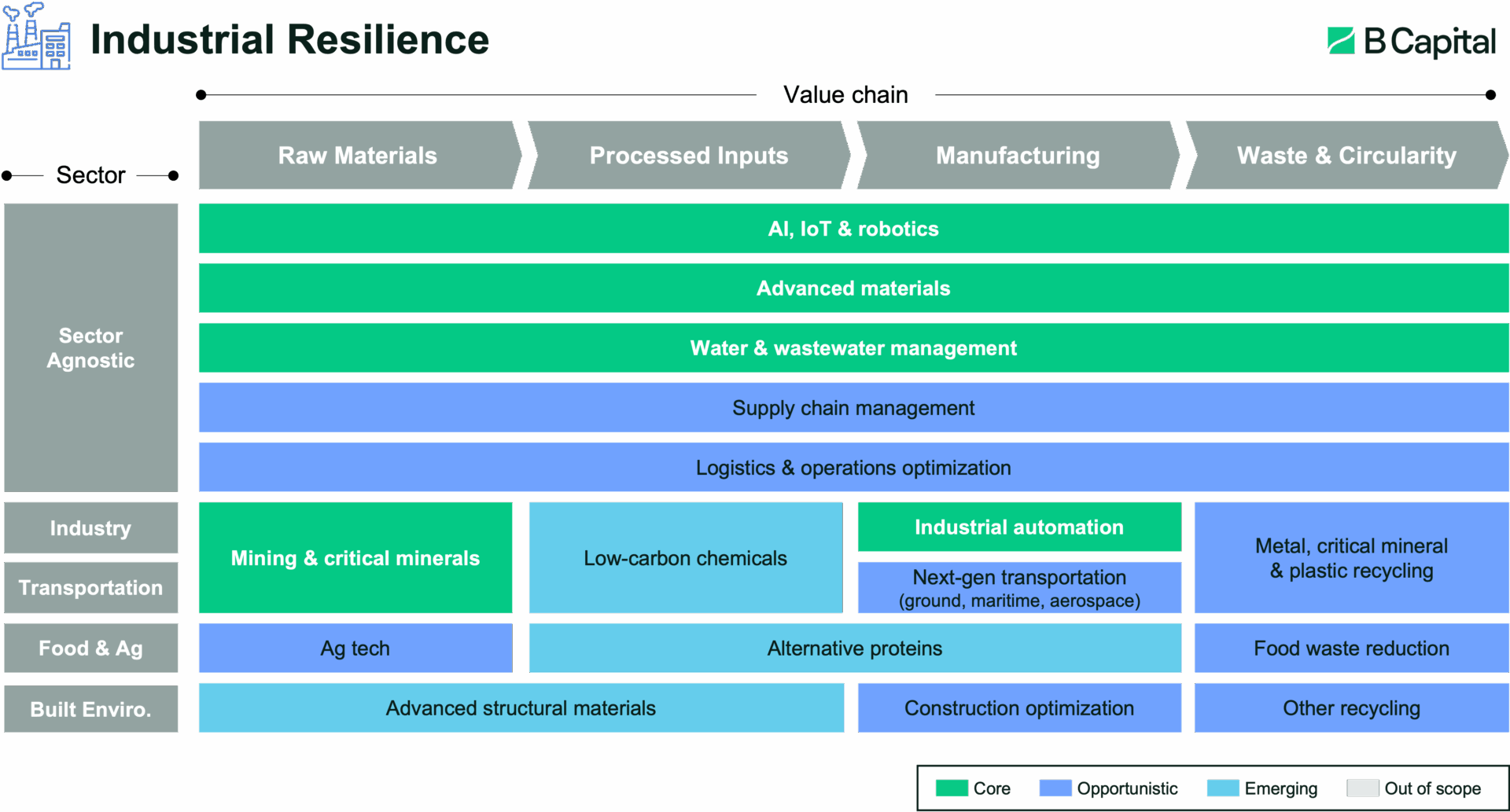

II. Industrial Resilience: Rebuilding the Global Supply Chain

Geopolitical shifts and the rapid development of energy and resilience technologies are reshaping global supply chains. Many innovative energy solutions rely heavily on critical minerals, the supply of which is concentrated in just a handful of countries—raising national security concerns for the U.S. and its allies. At the same time, manufacturing capacity remains heavily concentrated in China, creating additional geopolitical and supply chain risks that companies must navigate.

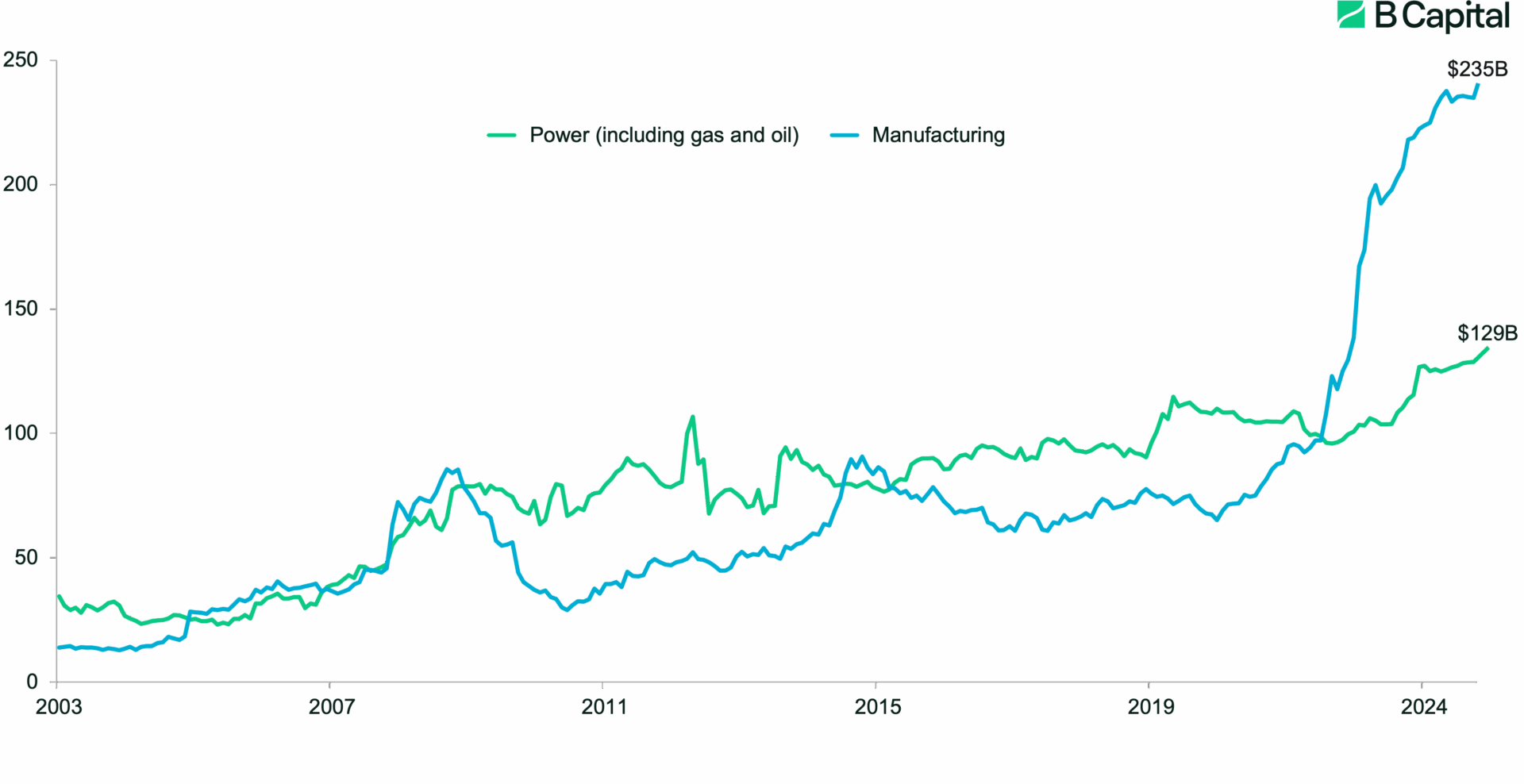

Derisking of Climate-related Global Supply Chains

Increasingly fragmented supply chains amid geopolitical tension, driving reshoring

U.S. Private Construction between 2003-2024 ($B)7

The result is a push to de-risk supply chains, reduce resource intensity and localize production wherever possible across sectors.

Where We’re Focused:8

- Resource efficiency and circularity: Technologies that reduce waste and improve the economics of mineral extraction and utilization

As ore grades decline and demand rises, we see growing interest in technologies that reduce the cost and improve efficiency of resource extraction and recycling. National security concerns are accelerating demand for domestic or allied access to these materials. - Domestic and allied manufacturing: Platforms that enable more secure, regionalized supply chains for critical industries

Between the Biden-era IRA and the Trump-era tariffs, there’s bipartisan momentum behind domestic manufacturing. Global industrial policy is coalescing around resilience, and automation, robotics and AI are changing the unit economics of onshore production. - Water resilience: Innovations in reuse, purification and conservation to address growing scarcity and regulatory pressure

Water is emerging as one of the next major input constraints, particularly for heavy industry, data centers and energy. Though historically underpriced, water is gaining recognition as a key operational and regulatory risk.

This trend is creating new opportunities for companies that can offer lower-risk, economically competitive alternatives in high-leverage supply chain categories. A key catalyst will be Physical AI—AI embedded in robotics, sensors, and industrial systems—to enable smarter, more adaptive infrastructure that can withstand geopolitical shocks, resource constraints, and operational volatility.

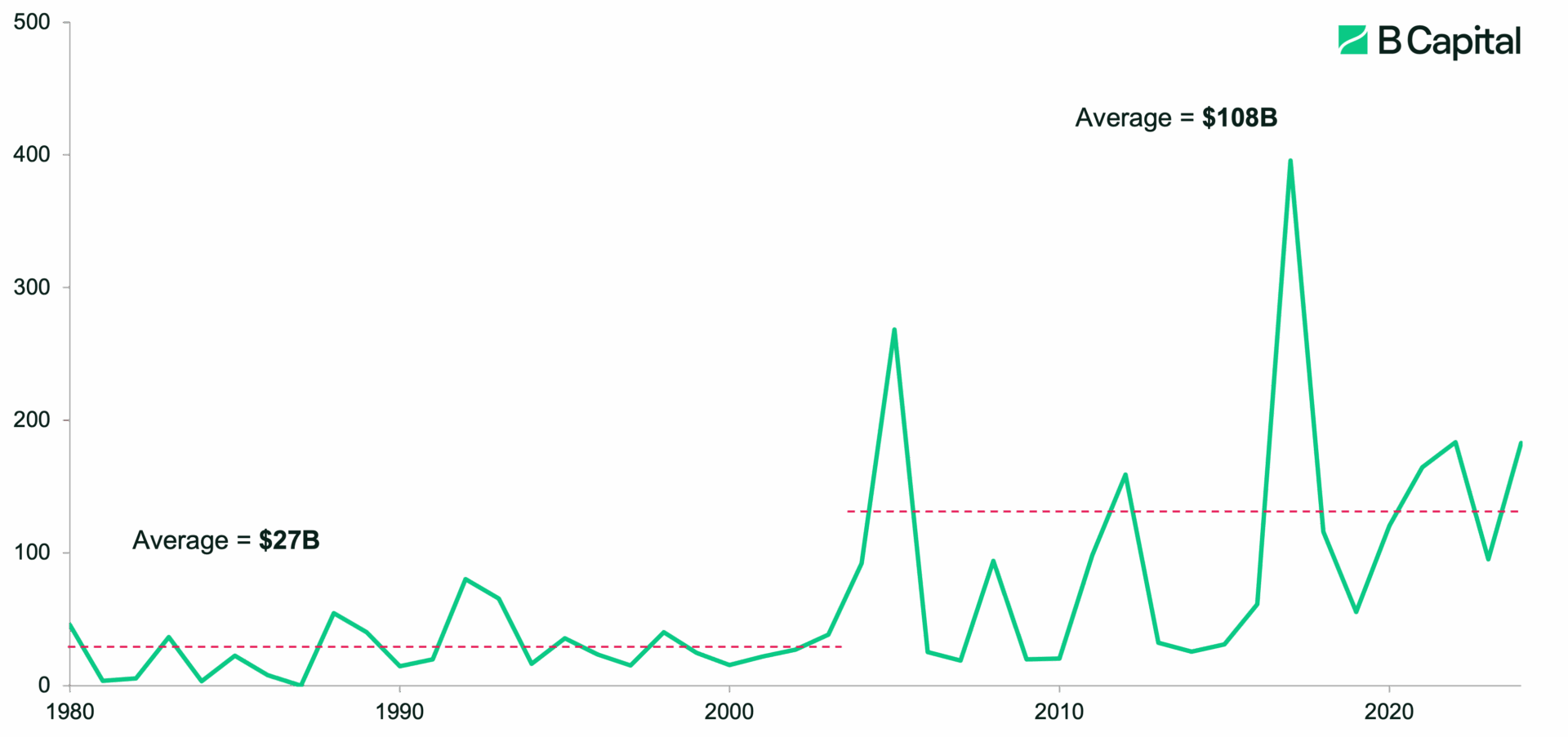

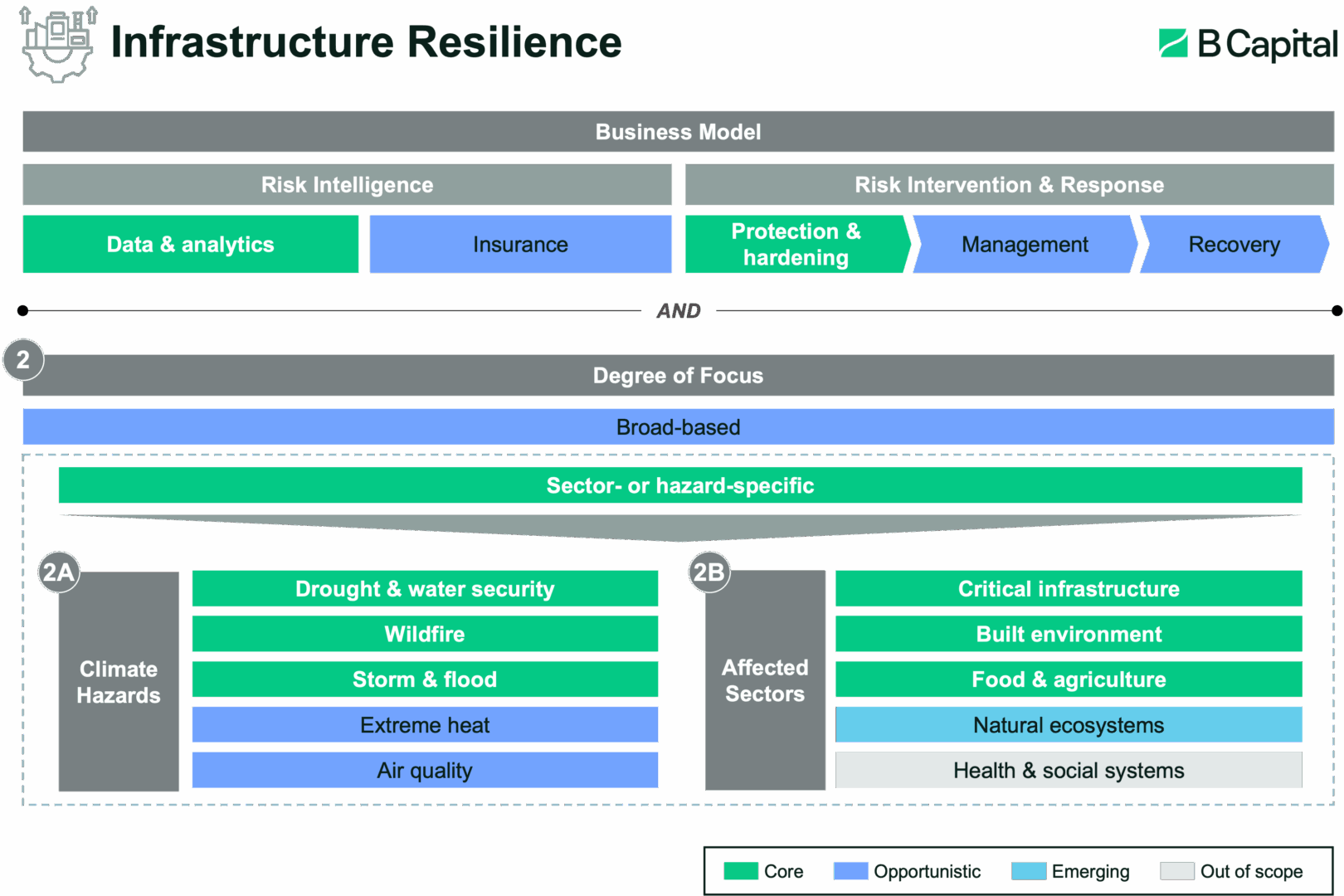

III. Infrastructure Resilience: Adapting to a New Weather Reality

Extreme weather is no longer a future scenario—it’s a recurring line item on corporate P&Ls. Companies across sectors are now actively planning for wildfires, floods, droughts and heat waves—not just to protect operations, but to reduce insurance costs, meet regulatory requirements and avoid disruption.

Escalating Impacts of Climate Change

Heat waves, wildfires, floods, drought and extreme weather driving increased need for adaption and resilience

Combined Cost of U.S. Weather and Climate Disasters (CPI-Adjusted $B)9

This marks a pivot in how we think about weather-driven adaptation. What was once considered reactive is now seen as proactive risk management and a significant cost to be optimized—and increasingly, a source of competitive advantage.

Where We’re Focused:10

We’re concentrating on the most pressing and economically significant climate risks—where disruption is already driving budget shifts, policy changes and new demand for resilient solutions.

- Climate risk intelligence: Tools that help enterprises and governments measure, model and mitigate weather and disaster exposure

Asset-intensive businesses are increasingly viewing climate modeling as core infrastructure, with improved data and AI models enabling more powerful use cases and applications. One example is Overstory (a B Capital portfolio company), which helps utilities optimize vegetation management in fire-prone areas—reducing operational costs while lowering wildfire risk. - Adaptation technologies: Infrastructure and services that reduce vulnerability to acute and chronic climate stressors

These include fire-resistant materials, heat-mitigating wearables, flood solutions and drought-proof water systems. Adaptation isn’t a future problem—it’s where capital is flowing today in response to visible disruption.

While mitigation remains critical, adaptation is where urgency is colliding with economic rationale—and where we see growing budget allocations and purchasing behavior.

Looking Ahead

Each of these megatrends—electrification, supply chain realignment, and climate adaptation—is massive in scope. But trends alone don’t generate returns. The key is identifying companies that are not only aligned with these shifts, but also meet our core investment criteria: scalability, strong and predictable unit economics, and commercial readiness that aren’t dependent on policy incentives. We’ll explore these criteria further in our next piece.

For now, the message is simple: in Resilience Tech, capital flows to fundamentals—and fundamentals follow the megatrends reshaping our world.

LEGAL DISCLAIMER

All information is as of 7.22.2025 and subject to change. Certain statements reflected herein reflect the subjective opinions and views of B Capital personnel. Such statements cannot be independently verified and are subject to change. The investments discussed herein are portfolio companies of B Capital; however, such investments do not represent all B Capital investments. It should not be assumed that any investments or companies identified and discussed herein were or will be profitable. Past performance is not indicative of future results. The information herein does not constitute or form part of an offer to issue or sell, or a solicitation of an offer to subscribe or buy, any securities or other financial instruments, nor does it constitute a financial promotion, investment advice or an inducement or incitement to participate in any product, offering or investment. Much of the relevant information is derived directly from various sources which B Capital believes to be reliable, but without independent verification. This information is provided for reference only and the companies described herein may not be representative of all relevant companies or B Capital investments. You should not rely upon this information to form the definitive basis for any decision, contract, commitment or action.

SOURCES

- S. Energy Information Administration, “How the United States Uses Energy,” Last updated July 15, 2024, accessed March 27, 2025, https://www.eia.gov/energyexplained/use-of-energy/.

- S. Energy Information Administration, “Short-Term Energy Outlook,” March 2025, https://www.eia.gov/outlooks/steo/report/elec_coal_renew.php. Accessed March 27, 2025.

- IEA, “EA World Energy Outlook 2024” data as of October 2024. APS (Announced Pledges Scenario) reflects climate targets and commitments as stated by governments, while STEPS (Stated Policies Scenario) projects outcomes based on currently implemented policies.

- IEA (International Energy Agency), Growth in Global Electricity Demand Is Set to Accelerate, January 2025. Available at: https://www.iea.org/news/growth-in-global-electricity-demand-is-set-to-accelerate-in-the-coming-years-as-power-hungry-sectors-expand

- For illustrative purposes only, areas of focus are subject to change.

- Nathan Shreve, Zachary Zimmerman, and Rob Gramlich, Fewer New Miles: The US Transmission Grid in the 2020s, Grid Strategies with support from Americans for a Clean Energy Grid, July 2024. Available at: https://cleanenergygrid.org/wp-content/uploads/2024/07/GS_ACEG-Fewer-New-Miles-Report-July-2024.pdf

- United States Census Bureau “Construction Spending – “Historical Data” as of 2024

- For illustrative purposes only, areas of focus are subject to change.

- National Centers for Environmental Information, ” United States Billion-Dollar Disaster Events 1980-2024 (CPI Adjusted)“

- For illustrative purposes only, areas of focus are subject to change.