Climate 3.0: Investing in Scalable, Profitable Climate Solutions

March 13, 2025

By: Jeff Johnson, Don Wood, and Karly Wentz

I. Introducing Climate 3.0

Climate investing is at a turning point. After two decades of rapid capital deployment, technological breakthroughs, and shifting policy landscapes, we are now in a new phase—one that moves beyond impact at the expense of economics toward a more disciplined, market-driven approach. This next phase, which we call Climate 3.0, shifts the focus to scaling business when they are ready to thrive on their own economic merits.

Past cycles—Cleantech 1.0 and Climate 2.0—helped lay the foundation for today’s market by advancing technology, driving down costs and increasing awareness of climate solutions. There were some high-profile successes in these past cycles; however, many companies struggled to commercialize effectively, resulting in billions invested with limited returns.

Our analysis of these past cycles led us to develop the Climate 3.0 framework, which we’ve been closely studying since mid-2024. The lesson is clear: for climate solutions to succeed, they must be grounded in strong economic fundamentals—not just policy incentives, corporate commitments, or high CO2 emission reductions.

Over the past 12 months, we’ve refined our investment strategy to address the challenges presented by previous climate investment cycles, adopting a more fundamentals-driven approach:

- Prioritizing strong unit economics and economic value.

- Focusing on scalable solutions with demonstrated real-world adoption.

- Applying rigorous growth investing principles to climate investments.

This article examines lessons from past cycles, key trends shaping Climate 3.0, and

B Capital’s strategy to capitalize on the market opportunity. It is the first in a series exploring our investment methodology, sector-specific opportunities and the companies leading this next phase.

Our thesis: the climate winners of the future will be those delivering sustainable, profitable growth—businesses that succeed not because of subsidies or mandates, but because they offer better, cheaper and more efficient solutions, often with co-benefits such as jobs and national security.

II. Climate 1.0 (2006–2012): Betting on Disruption Without the Right Foundations

Climate 1.0 (2006–2012) was the “clean tech” era, fueled by venture capital enthusiasm for renewable energy, electric vehicles (EVs) and biofuels. Investors poured $25B+1 into climate startups, betting on market disruption and technological breakthroughs.

During this period, some companies, like Tesla, defied the odds, proving that clean technology could compete with legacy industries. However, most failed due to fundamental flaws in unit economics and commercialization.

Challenges and Lessons from Climate 1.0

Despite early optimism, most Climate 1.0 companies struggled to achieve sustainable growth due to several key challenges:

- Capital-intensive business models struggled to scale. Without patient capital or strong market incentives, many startups struggled to secure follow-on funding. High-cost models with long payback periods proved difficult to sustain, particularly in infrastructure-heavy sectors.

- Markets weren’t ready for broad adoption. While technologies like biofuels were technically viable, their higher costs compared to conventional alternatives hindered adoption. Additionally, customers were reluctant to invest in the infrastructure needed to leverage these innovations. Even the best technology can struggle without favorable market conditions.

- Government incentives alone couldn’t drive sustainable demand. Many companies relied heavily on subsidies and tax credits, but when policy support shifted, their business models became unsustainable. Long-term viability requires economic competitiveness and cannot rely solely on policy-driven demand.

- Scientific progress doesn’t follow a set timeline. Breakthroughs can’t be rushed, and many companies struggled when commercialization timelines didn’t align with the pace of scientific discovery. Building a business ahead of the science proved risky and unpredictable.

While Climate 1.0 demonstrated the potential of clean technology, it also underscored the need for better market and industry alignment. The experience reinforced that commercialization is more important than innovation alone. Government support is not a substitute for commercial viability and companies must compete on price and performance to survive. These lessons shaped Climate 2.0, which brought more expertise and capital but introduced new challenges of its own.

III. Climate 2.0 (2013–2023): More Capital, More Expertise—But Challenging Fundamentals

Climate 2.0 represented a shift from the early clean tech era, rebranding the sector as “climate tech” and attracting a more sophisticated investor base. Institutional investors, corporate venture arms, high-net-worth individuals, family offices and government-backed initiatives like the Inflation Reduction Act (IRA) helped drive over $200 billion2 in capital into the space. This period was characterized by optimism, a belief in the scalability of climate solutions and a rush to deploy capital into technologies that promised to accelerate the energy transition. Furthermore, many investors backed businesses with high carbon impact, betting that the decarbonization benefits would create value—even when the solutions were significantly more expensive than existing alternatives. However, that assumption proved difficult to sustain.

This wave of investment was also enabled by a historically low-interest rate environment, which allowed capital-intensive models to thrive despite weak underlying economics. With abundant, cheap capital, many climate companies were able to sustain operations and expand aggressively, even if their business models were not fundamentally sound. This environment obscured deep structural challenges, resulting in overinvestment in speculative sectors and inefficient capital allocation.

Challenges and Lessons from Climate 2.0

Despite an influx of capital and growing institutional interest, many Climate 2.0 companies struggled to achieve long-term success due to several key challenges:

- Misaligned incentives weakened business models. Many companies were built around voluntary carbon pricing and corporate commitments, assuming regulatory support and net-zero pledges would create a sustainable revenue stream. But these mechanisms proved volatile and unreliable, leaving businesses exposed when corporate priorities shifted or regulatory frameworks failed to materialize as expected.

- Valuation bubbles and capital misallocation distorted the market. The SPAC boom and broader tech euphoria led to inflated valuations, with many climate companies raising substantial funding at unrealistic multiples. This drove overfunding of underperforming businesses, while crucial sectors remained underfunded.

- Overdependence on cheap capital proved unsustainable. Near-zero interest rates fueled rapid growth but encouraged unsustainable practices. Companies focused on expansion and capital-intensive technologies over profitability, creating vulnerabilities when rates rose sharply in 2022,3 making many business models untenable without cheap financing.

While Climate 2.0 brought greater expertise and institutional capital, it also reinforced key investment lessons: commercialization and scale matter more than innovation alone, valuation discipline is essential to avoiding market corrections and capital efficiency is critical in a higher interest rate environment. Companies must prioritize profitability, scalability and cost discipline—long payback periods and capital-intensive models are difficult to sustain. These lessons have shaped the emergence of Climate 3.0, where market-driven, economically viable businesses will define the next era of climate investing.

IV. The Climate 3.0 Investment Framework: A More Disciplined, Market-Driven Approach

Climate 3.0 builds on the lessons from the past two decades of climate investing, shifting toward an investment strategy that prioritizes economic fundamentals, scalability, partnerships and resilience. This phase is driven by long-term structural trends, not policy shifts, and will persist regardless of global political circumstances.

While early-stage innovation is crucial, R&D investment should be prioritized when a clear, scalable commercial path exists. New technologies will drive climate solutions, but the focus must remain on those that are both impactful and economically viable. Scaling business models where costs—such as labor, materials, or operations—rise disproportionately with growth does not tend to lead to lasting success, as these inflationary models struggle to achieve sustainable profitability. In this phase, we must prioritize solutions that achieve both meaningful impact and financial viability.

Read more about how B Capital uses the Adoption Readiness Levels (ARL) framework to evaluate whether climate companies can scale beyond innovation in:

What Defines Climate 3.0?

The companies that succeed in Climate 3.0 will share key characteristics that set them apart from the models of the past:

- Market-Driven and Economically Competitive – The best climate solutions will win because they offer cost savings, efficiency gains or superior performance—not because they rely on subsidies or policy mandates. These solutions will attract ready customers with the budget and willingness to adopt them.

- Scalable Capital Efficient – Growth-stage climate companies must demonstrate clear paths to profitability, without relying on large, continuous funding rounds. Some of the best companies will also develop innovative partnerships to be more efficient with capital and resources.

- Resilient to Market Cycles – Climate investing should not be dependent on regulatory volatility, green premiums or short-term economic conditions. The strongest companies will be those that can adapt to changing market dynamics and maintain demand in any environment.

- Technologically Ready for Deployment – Innovation remains essential, but the focus is to scale-up companies with proven technologies, not speculative R&D-heavy models. The ability to move from pilot stage to full deployment is critical.

- Aligned with Structural Megatrends – The Climate 3.0 investment landscape is shaped by major shifts such as electrification, supply chain realignment, and climate adaptation. Companies positioned to capitalize on these trends will be best equipped for long-term success.

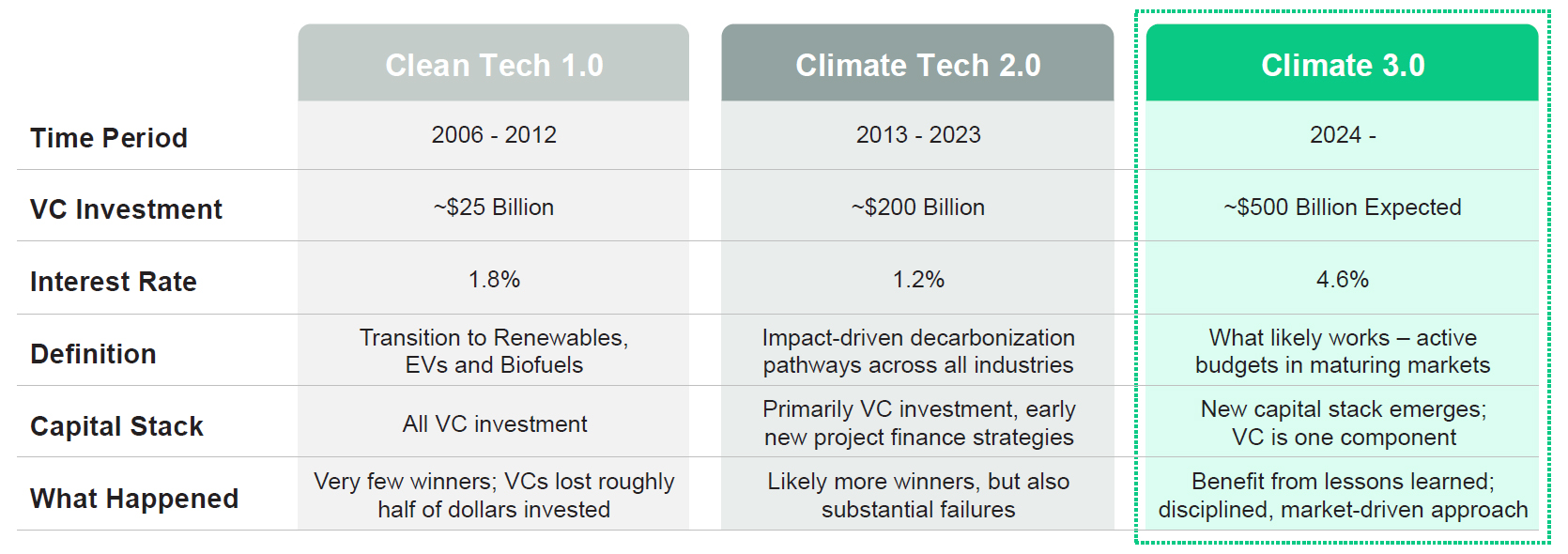

Evolution of Climate Tech Investing4,5,6

(B Capital, 2025)

Conclusion: Investing in the Future of Climate at Scale

At B Capital, our analysis of the climate investment landscape has led us to believe that the most impactful climate solutions will come from companies that can scale profitably and endure over time. As growth investors, our role is to back businesses that have moved beyond early-stage development and are positioned for rapid expansion with strong commercial traction.

We care deeply about impact, but we also recognize that the companies that achieve real, lasting change will be those that can compete and thrive on their own economic merits. Venture capital plays a specific role within the broader climate investment landscape, and not all climate solutions are suited for VC funding.

Building on the successes and challenges of Climate 1.0 and 2.0, we now have a clearer understanding of what works and where capital should be deployed for the greatest impact and returns. For growth-stage climate companies, success will come from their ability to scale profitably, withstand market shifts, and deliver durable returns—without depending on subsidies or policy-driven demand.

In the next article, we will explore the megatrends shaping Climate 3.0 in greater depth, outlining the investment opportunities that will define this next era.

LEGAL DISCLAIMER

All information is as of 03.12.25 and subject to change. Certain statements reflected herein reflect the subjective opinions and views of B Capital personnel. Such statements cannot be independently verified and are subject to change. Reference to third-party firms or businesses does not imply affiliation with or endorsement by such firms or businesses. It should not be assumed that any investments or companies identified and discussed herein were or will be profitable. Past performance is not indicative of future results. The information herein does not constitute or form part of an offer to issue or sell, or a solicitation of an offer to subscribe or buy, any securities or other financial instruments, nor does it constitute a financial promotion, investment advice or an inducement or incitement to participate in any product, offering or investment. Much of the relevant information is derived directly from various sources which B Capital believes to be reliable, but without independent verification. This information is provided for reference only and the companies described herein may not be representative of all relevant companies or B Capital investments. You should not rely upon this information to form the definitive basis for any decision, contract, commitment or action.

SOURCES

- Benjamin Gaddy, Varun Sivaram, and Francis O’Sullivan, “Venture Capital and Cleantech: The Wrong Model for Clean Energy Innovation,” MIT Energy Initiative Working Paper, July 2016, https://energy.mit.edu/wp-content/uploads/2016/07/MITEI-WP-2016-06.pdf.

- Boston Consulting Group, “From Clean Tech 1.0 to Climate Tech 2.0: A New Era of Investment Opportunities,” June 30, 2023.

- International Monetary Fund, Corporate Sector Vulnerabilities and High Levels of Interest Rates(Washington, DC: International Monetary Fund, 2025), https://www.imf.org/en/Publications/Departmental-Papers-Policy-Papers/Issues/2025/01/08/Corporate-Sector-Vulnerabilities-and-High-Levels-of-Interest-Rates-556372.

- “State of Climate Tech 2023: How can the world reverse the fall in climate tech investment?” PwC, October 2023; “$32bn and 30% drop as market hits pause in 2023” Sightline Climate, January 2024.

- Information as of September 30, 2024. This information was calculated in the sole discretion of B Capital and therefore such information is based on the best estimates of B Capital. If B Capital were to use different methodologies, the results may be materially different. As a result, prospective investors should not place undue reliance on the information herein and such information should not be used as a basis for investment decisions regarding an investment in any investment fund managed by B Capital. Applying historical average annual energy transition deployment growth of 25% (2013 – 2023, per BNEF), to annual climate tech investment per Sightline Climate from 2024 – 2034.

- Average federal funds rate; 2024 represents 2024 average YTD federal funds rate.