The 10 Factors That Guide Our Resilience Tech Investments

September 18, 2025

By: Jeff Johnson, General Partner & Head of Energy & Resilience, B Capital and Karly Wentz, Partner, B Capital

The world is entering a new era of disruption driven by geopolitical instability, resource scarcity, weather extremes, and aging infrastructure. At B Capital, we invest in Resilience Tech—companies building the energy, industrial, and infrastructure systems that keep industries, governments and communities running when it matters most. We outlined our approach in Resilience Tech: Systems That Withstand What’s Next.

Building in this space isn’t easy. Compared to other areas of investing, Resilience Tech covers a broad range of businesses including hardware, software, deep tech, and infrastructure. It requires balancing capital intensity with efficiency, navigating regulation and real-world complexity and proving both technical and commercial viability. As we explored in Climate 3.0: Investing in Scalable, Profitable Climate Solutions, success comes from pairing strong business fundamentals with solutions that can scale.

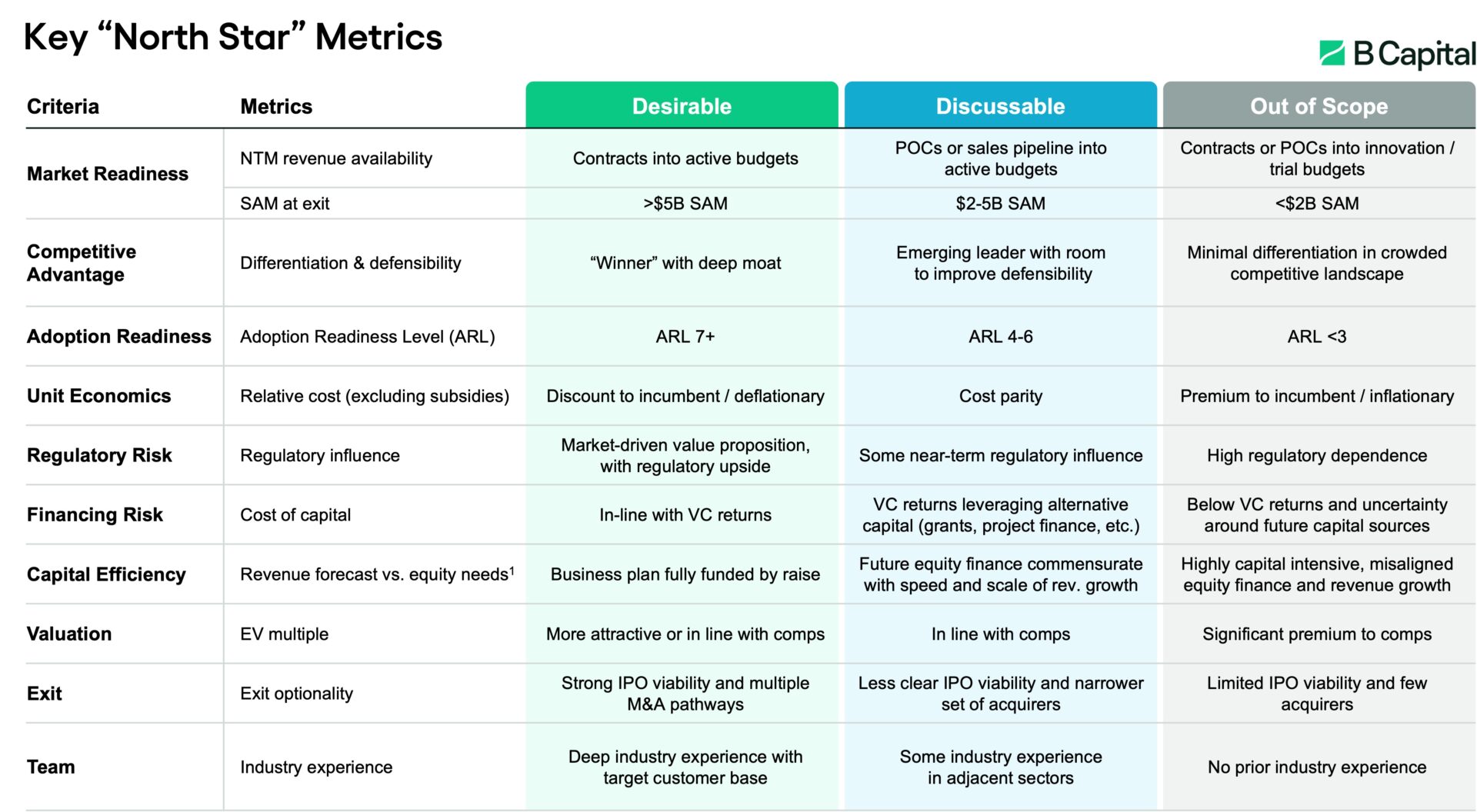

Below is our 10-point “North Star” growth investment framework—an outline of how we typically underwrite companies and how we believe the most successful companies will be built. It’s designed to assess which technologies will succeed not just in theory, but in practice.

Note: For illustrative purposes only and subject to change. Certain statements reflected herein reflect the subjective opinions and views of B Capital and its personnel. Such statements cannot be independently verified and are subject to change. Actual portfolio construction and returns of investments will vary.

1. Multiple metrics used to inform capital efficiency, including forward burn multiple (projected cumulative cash burn / new annual revenue over next two years) and net value creation multiple (projected enterprise value at exit – current pre-money valuation) / total equity raised through exit, including current round)

1. Market Readiness: Customer Pull, Not Just Potential

The first thing we ask is whether the market is ready, and whether a company can build a real scaled business. Too often, early-stage climate startups fall into what we call the “first-of-a-kind folly”: pilots look promising, but the jump to the first commercial-scale project never happens. To us, a ready market is one where customers are pulling solutions in, with budget lines, procurement processes, and incentives already in place to support adoption. That pull matters because it separates an interesting technology from a business that can scale.

That’s why we prioritize companies earning revenue from their customers’ operating budgets rather than from marketing or innovation budgets. It shows that the product is solving a core need. We also look closely at whether a company has chosen the right entry point for today’s market, not just the market as it might exist a decade from now. Too often we see products designed for the way the world should work in 10 to 20 years, before the infrastructure, incentives or customer behavior are in place to support them. For example, the smart grid companies of the 2010s were working on interesting technologies, but struggled commercially because the market wasn’t yet ready.

In addition to prioritizing real revenue, we look for large markets that can support a scaled VC-backable business. We don’t inflate numbers with a theoretical TAM, we focus on the Serviceable Addressable Market (SAM) at exit—the share that can realistically be captured and turned into revenue.

Best-in-class benchmarks:

- $10M+ in next-twelve-months (NTM) revenue

- Signed contracts or conditional purchase orders (POs) into recurring, active budgets

- SAM > $5B, with a credible path to penetration

These aren’t hard gates, plenty of exceptional companies fall short on one or more of these and still go on to be generational businesses. But they’re the markers that help give us conviction.

2. Competitive Advantage: Be a Painkiller

In a space where dozens of companies claim to solve the same problem, differentiation is everything. We look for Resilience Tech startups offering transformative products, not just incremental improvements. Many Resilience Tech solutions have long been vitamins, helpful but not essential. We’re looking for painkillers.

We are most confident in companies that demonstrate a structural moat, whether it be through proprietary technology, superior data, privileged access or unique distribution.

Best-in-class benchmarks:

- Clearly articulated differentiation that customers care about and are willing to

pay for - Defensibility through IP, network effects, data or supply chain

- Emerging winner in their category

In a crowded field, small technical differences rarely stand out. Real breakthroughs come from clear, meaningful advantages.

3. Adoption Readiness: Proven Tech that Can Scale

We invest in proven technologies with a clear path to commercialization. Too often, Resilience Tech startups focus on technical milestones and delay what is often the more salient question: How can this solution be adopted at scale? The traditional Technology Readiness Level (TRL) framework falls short in answering this. That’s why we use the Department of Energy’s Adoption Readiness Level (ARL) framework, which evaluates a technology’s commercial viability.

The ARL framework expands the lens to include 17 dimensions across four critical categories:

- Value Proposition – Does the product solve a real customer problem at a compelling price?

- Market Acceptance – Does the company have the channels, partnerships, and operating model needed to translate demand into scaled adoption?

- Resource Maturity – Can the company secure the inputs and partners it needs to scale?

- License to Operate – Are regulatory, community, and permitting hurdles addressed?

Best-in-class benchmarks:

- ARL 7+, signaling readiness for scaled deployment (i.e., proven customer demand and market conditions to support adoption)

- Demonstrated ability to move from pilots to multi-site or repeatable deployments

- Proactive strategies to overcome deployment risk, not defer it

The ARL framework has become a cornerstone of our investment process because it captures what most TRL-based evaluations miss: a realistic path from prototype to product to platform.

We break this down further in our article on why ARLs are essential to scaling climate tech.

4. Unit Economics: Beyond Green Premiums

We believe the most impactful climate solutions are those that become cheaper with scale. If a product depends on a permanent green premium—even as more of it is produced—it will struggle to grow. Our threshold is clear: the business must stand on its own, with no subsidies built into the cost base.

Best-in-class benchmarks:

- Cost parity or better vs. incumbent solutions

- A clear path to long-term cost leadership

- Scalable, margin-positive unit economics without dependency on policy levers

5. Regulatory Risk: Beware of the Stroke of the Pen

Policy can be a powerful tailwind, but it shouldn’t be the foundation of a business. In markets like sustainable aviation fuel (SAF) and direct air capture (DAC), where demand today is almost entirely policy-driven, we proceed carefully. If a market could vanish with a single regulatory change, court ruling, or election result, it doesn’t have the durability we look for.

Best-in-class benchmarks:

- A market-driven value proposition

- Potential for short-term regulatory upside, but long-term independence necessary

- Focus on de-risking any policy exposure

Direct subsidies can catalyze adoption by improving near-term unit economics, while broader policy tailwinds create long-term demand shifts, but in both cases, the underlying product must be commercially viable on its own.

6. Financing Risk: Match the Story to the Structure

Financing can accelerate a company’s growth or quietly undermine it. The strongest companies raise the right kind of capital at the right time. Not every business is suited for venture funding; some sectors are better served by philanthropies or corporate partners. That’s why every company should think about financing early and build a plan aligned with the types of capital that will realistically be available. For example, in some cases grants or customer pre-payments are available while project finance, often mistakenly cited as an early option, is typically only accessible once technology is proven and cash flows are contracted.

Success comes from sequencing. Companies must align technical and commercial milestones with financing, building credibility step by step. Too many stumble not because the technology failed, but because the financing story did. The rule is simple: know when cheaper capital will be available to you, tie every dollar to a milestone that de-risks the business, and sequence raises to create options. Great founders don’t just build technology—they match the structure of their financing to the story of their company.

Best-in-class benchmarks:

- Source of capital aligned with business needs and risk

- Maximal leverage from lowest cost capital available

- Clear view into future financing rounds

7. Capital Efficiency: Efficient Doesn’t Mean Cheap

Some of the best opportunities in energy and resilience are capital-intensive. That’s not a problem—so long as capital is used efficiently. We evaluate companies using tools we’ve developed internally like the two-year forward burn multiple (burn / projected new revenue) and the net value creation multiple (projected enterprise value uplift between current round and exit / total projected future equity raised, including current round) to ensure that when we do invest in capital-intensive businesses, there is a clear path to value accretion.

Best-in-class benchmarks:

- Business plan fully funded by the raise

- Strategic capital deployment tied to measurable milestones that increase value

- A credible path to capital-efficient scale, whether via partnerships, outsourcing, asset-light models or low-cost capital

8. Valuation: Don’t Raise Like Tech If You Operate Like Industry

Raising using software company valuation multiples while running an industrial business with inherently lower multiples creates misalignment that is almost impossible to unwind as the company grows. Too often, founders pitch with tech-company narratives but deliver industrial-company margins. The result: inflated valuations, misaligned investor expectations and painful resets down the line.

Best-in-class benchmarks:

- Realistic expectations on valuation multiples

- Reasonable comps tied to current market conditions

- Clear revenue growth and margin targets

9. Exit: Don’t Price Yourself Out of a Win Too Early

We evaluate exit paths before we invest. The best companies can go public, but acquisitions are a common path. If cap tables or valuations make M&A functionally impossible, founders risk closing off their most likely path to success.

Best-in-class benchmarks:

- Multiple credible exit pathways

- Valuation discipline at each stage

- Alignment between cost of capital, growth strategy, and target acquirers

If the most likely outcome is M&A, don’t raise in a way that blocks that option. For example, avoid setting valuations so high that potential acquirers are priced out.

10. Team: Build with Business Builders

We value technical depth—but we invest in business builders. The strongest founders pair technical innovation with the ability to sell and scale products. We look for teams that know how to operate in messy, regulated, infrastructure-heavy sectors. We also place a premium on strong and effective leadership that can guide a company through its various phases of growth, attracting top talent along the way.

Best-in-class benchmarks:

- Industry experience with the target customer

- A proven ability to secure contracts

- Demonstrated leadership and ability to develop a best-in-class team

Commercial capabilities need to grow alongside the technology to position the business for success. Founders that prioritize commercialization in parallel with tech are best positioned to win.

Conclusion

Underlying all of this is impact. The strongest Resilience Tech companies deliver measurable improvements: power grids that stay online, supply chains that withstand shocks, infrastructure that endures weather extremes. When outcomes can be tracked in uptime, cost savings or avoided emissions, it drives adoption, validates durability and cements long-term value. Impact also extends beyond the commercial sphere. The best companies advance planetary resilience with clear environmental benefits, while demonstrating political resilience by offering solutions that resonate across the political spectrum. Companies that combine measurable outcomes with broad-based relevance are best positioned to scale and endure.

This framework isn’t about perfection. It’s about alignment. We’re excited to work with founders and teams who are honest about their risks, intentional about their strategies, and bold in their ambition. The most compelling entrepreneurs are magnetic, open-minded and resilient leaders who push through obstacles with unending optimism and inspire others to join them. The strongest companies emerge as industry leaders with deep markets that can be understood by financial markets and analysts. And perhaps most importantly, the most valuable opportunities are those solving the world’s biggest and most urgent challenges.

Our Resilience Tech investment thesis is grounded in a simple belief: the next decade belongs to the companies that can scale. That means prioritizing businesses with proven potential to grow and deliver lasting impact. This framework helps us identify those opportunities, and we hope it’s a useful tool for entrepreneurs and other investors to do the same.

LEGAL DISCLAIMER

All information is as of 9.10.2025 and subject to change. This content is a high-level overview and for informational purposes only. Certain statements reflected herein reflect the subjective opinions and views of B Capital personnel. Such statements cannot be independently verified and are subject to change. Reference to third-party firms or businesses does not imply affiliation with or endorsement by such firms or businesses. It should not be assumed that any investments or companies identified and discussed herein were or will be profitable. Past performance is not indicative of future results. The information herein does not constitute or form part of an offer to issue or sell, or a solicitation of an offer to subscribe or buy, any securities or other financial instruments, nor does it constitute a financial promotion, investment advice or an inducement or incitement to participate in any product, offering or investment. Much of the relevant information is derived directly from various sources which B Capital believes to be reliable, but without independent verification. This information is provided for reference only and the companies described herein may not be representative of all relevant companies or B Capital investments. You should not rely upon this information to form the definitive basis for any decision, contract, commitment or action.