Unlocking Deep Tech Potential in the Gulf Cooperation Council (GCC)

March 7, 2024

By Eduardo Saverin, Raj Ganguly & Kaustubh Wagle

Deep Technologies (Deep Tech) solve complex problems and typically entail years of groundbreaking research, innovation and development, which require significant and continued funding over a sustained period. Examples include Artificial Intelligence (AI), blockchain, biotechnology and quantum computing. These technologies can help solve complex and critical environmental and societal issues globally, such as achieving global Net Zero goals, addressing resource scarcity, catering to the healthcare needs of an aging population, and more.

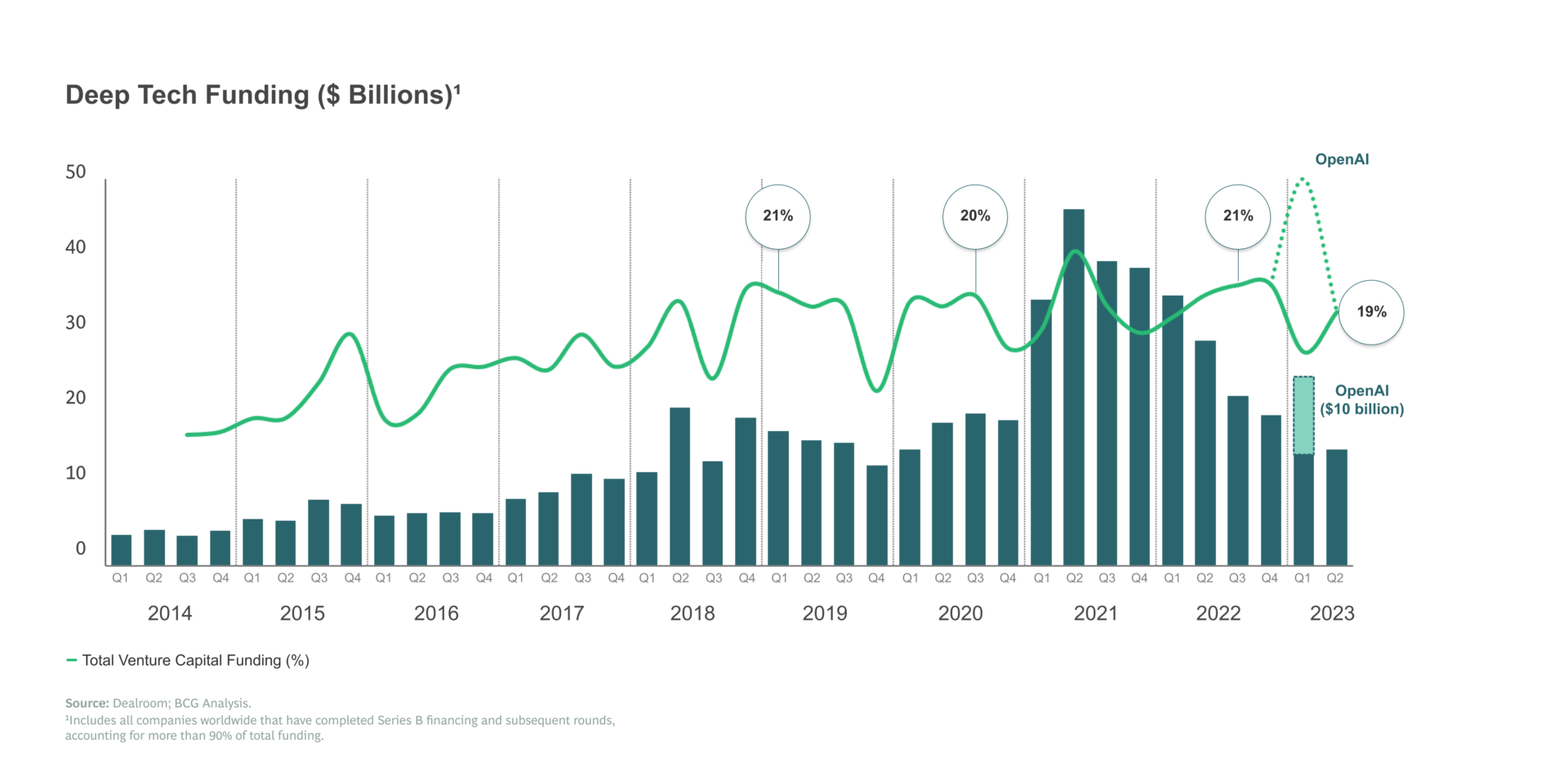

Over the past decade, investment returns in Deep Tech have been similar to or marginally better than those in traditional venture capital (VC). Because of this track record of Deep Tech VC investments, the space has increased in popularity, accounting for approximately 20% of total venture funding globally over the last five years.

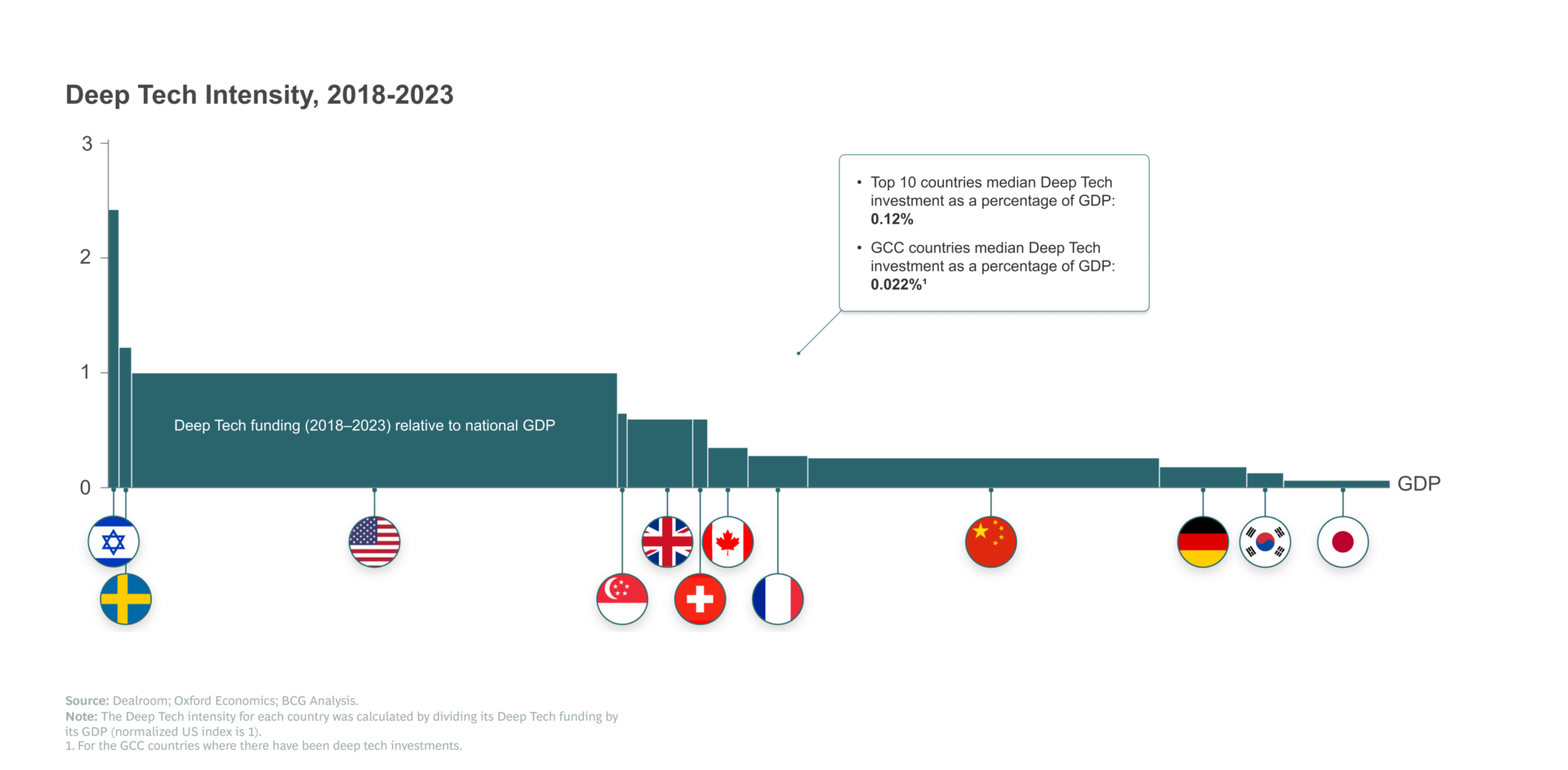

While Deep Tech investment across the Gulf Cooperation Council (GCC) has lagged the wider market to date, the region has the potential to become a leader in cutting-edge technologies while generating strong investor returns.

Attractive Investment Alignment

There are several key reasons why the GCC is attractive for Deep Tech VC, including:

- Government Support: The GCC region is invested in diversifying its economy from oil and other commodities. The government has implemented several initiatives to bolster the technology ecosystem, including new innovation hubs, funding and grants, streamlined regulations and licensing procedures, friendly tax policies and special economic zones. This has created a conducive environment for entrepreneurship.

- Investor Interest: Deep Tech investments already resonate with many prominent investors and sovereign wealth funds in the region. GCC investors often embrace a dual mandate, seeking both financial returns and actively contributing to economic development. Additionally, investors outside of the GCC continue to recognize the potential of startups in the region and are actively seeking attractive investment opportunities. With this funding influx, startups have been scaling their operations and developing innovative solutions.

- Economic Growth and Market Demand: The region has grown significantly in recent years fueled by a growing population that now exceeds 50 million people. More than 50% of GCC’s population are under the age of 25 and have a growing appetite for digital products and services. The GCC’s financial wealth is estimated to grow 4.7% annually to reach $3.5 trillion by 2027, according to research from Boston Consulting Group (BCG), and startups are poised to continue tapping into this market with innovative digital products and services.

Significant Capital

The deep pool of investable capital held by GCC investors is a strong pull for companies and investment firms seeking to secure funding. Recently, the CEO of OpenAI, Sam Altman, was in conversation with UAE officials to raise $5-7 trillion for a capital-intensive initiative focused on establishing chip factories. That level of capital is not often available through conventional venture channels or government grants, presenting a unique opportunity for the GCC.

Many companies are looking to the GCC for expansion opportunities as well. For example, B Capital’s portfolio company Insilico, an AI-enabled drug discovery biotech startup, launched its Generative AI and Quantum Computing R&D Center in the UAE last year. The decision was influenced by the region’s central location, appealing time zones for global collaboration, inclusive and business-friendly policies and access to affordable renewable energy for model training.

Capitalizing on This Compelling Market Opportunity

$3 Billion Per Year Investment Opportunity: Based on BCG research, if annual Deep Tech VC investment in the GCC as a percentage of GDP achieves the median level of global top-10 countries, the region’s Deep Tech investment market could reach $3 billion annually over the next five years.

Fostering New Sectors of the Economy: The wider VC market in the GCC is still in its nascent stages and is narrowly concentrated in sectors such as e-commerce and fintech primarily focused on venture and early-growth startups. While Deep Tech VC investments are currently rare in the GCC, there is a large opportunity that can also help broaden the region’s existing VC market.

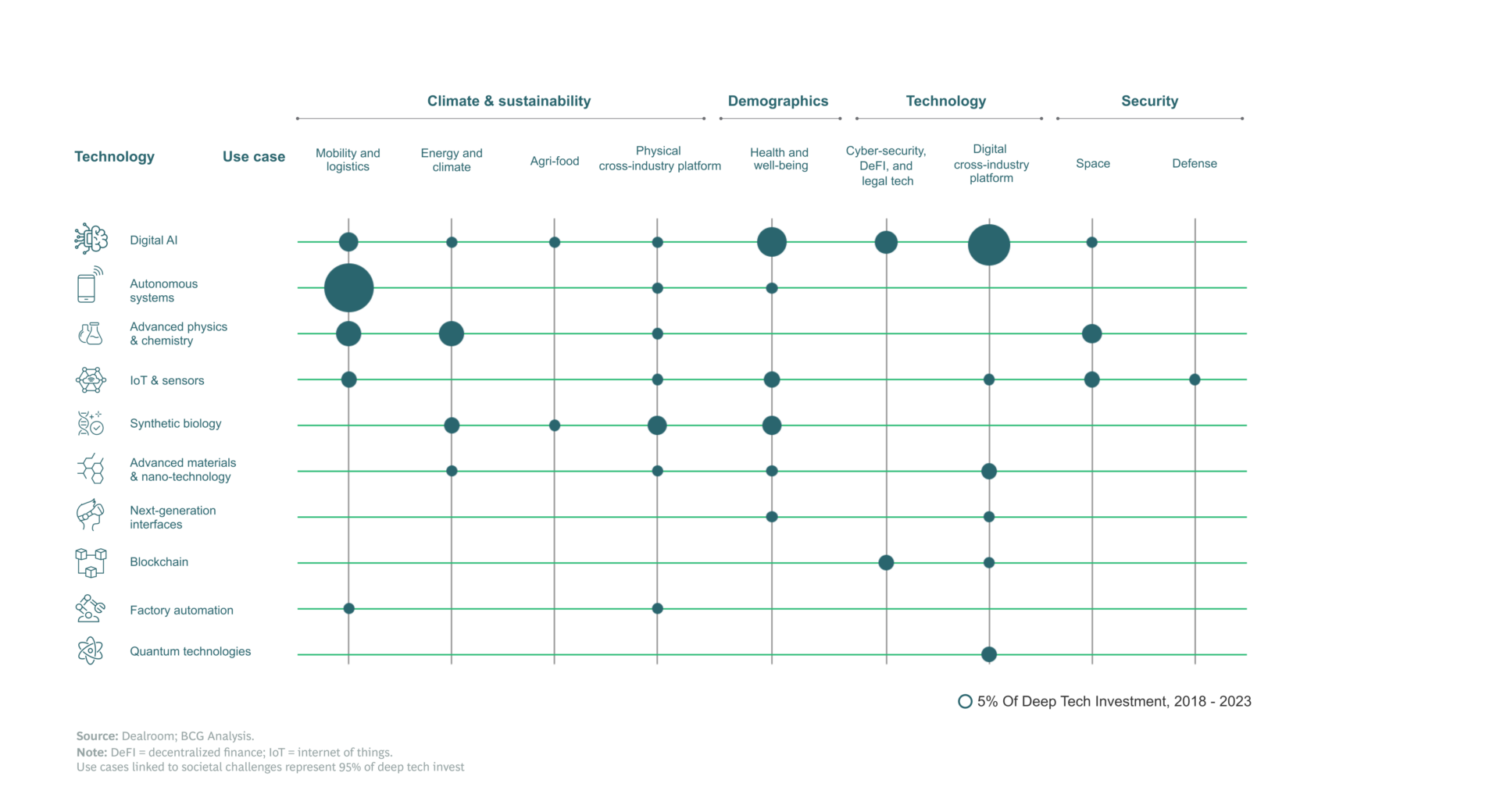

The following are attractive segments:

- Artificial intelligence – Multiple GCC countries are spearheading the integration of AI as a part of their national ambitions, which can drive transformation in high-demand sectors such as energy, healthcare, mobility, and logistics.

- Autonomous systems in mobility and logistics – The region’s ambitious urban projects can drive demand for innovative transportation solutions, enhancing passenger and freight mobility.

- Agri-food – With limited natural soil, ensuring food security is critical. Compared to other countries where traditional agriculture is efficient and scalable, the GCC is willing to pay a premium for new technologies.

- Climate Tech – The GCC has demonstrated leadership and intent in tackling climate change and achieving net zero targets. COP28 has further driven the region’s focus on renewable energy — the UAE alone has committed $30 billion in climate investment funds to support global climate solutions and $150 million for water security solutions.

Below summarizes existing Deep Tech investments globally from a recent BCG publication.

Playing the Long Game

Deep Tech investing requires navigating early-stage risks, from scientific feasibility to market interest and ultimate adoption. The GCC’s approach, informed by insights on the necessity for significant funding and support for technologies as they mature, can shape the future of various sectors critical to global well-being and economic resilience.

For Deep Tech startups, GCC countries offer economic growth, an attractive destination for talent, the presence of many global companies, growing interest from global investors and strong IPO markets.

In addition, GCC countries may also invest further in their relevant ecosystems, including through educational and R&D institutions, R&D budgets, incentives to attract highly educated talent, attractive partnership structures with state companies and other long-term incentives.

With these natural strengths and focused leadership, the GCC region can propel future growth by focusing on Deep Tech investing, helping drive the next cycle of global innovation.

***

Learn more about Deep Tech investments in BCG’s recent publication, ‘An Investor’s Guide to Deep Tech Investing’

***

About the authors

Eduardo Saverin is the Co-Founder and Co-CEO of B Capital, a global multi-stage technology investment firm. He was also the first investor in and Co-Founder of Facebook/Meta.

Raj Ganguly is the Co-Founder and Co-CEO of B Capital. Mr. Ganguly was previously at Bain Capital where he focused on driving growth and operational improvements in consumer and technology enabled portfolio companies across the United States and Asia.

Kaustubh Wagle is Managing Director & Partner at Boston Consulting Group (BCG), a global consulting firm. He leads BCG’s Tech Investments sector in the Middle East, and advises corporates, VC/PE funds and sovereign wealth funds on strategy, tech investments and business building.