India’s Digital Healthcare Sector: A $37 Billion Opportunity

April 8, 2024

By Karan Mohla, General Partner, Chandan Deep, Vice President Strategy and Operations, Deepanshu Pattanayak, Principal, and Mehul Garg, Associate, B Capital

India’s health tech sector is at a critical inflection point, demonstrated by the experience of one mother who reflects the interests of 1.5 billion Indians. Before 2020, Anusha Sharma, a realtor based in Mumbai, wouldn’t have dreamt of uploading personal health details into an app. But after Covid-19, the tele-consult and e-pharmacy startups that sprung up across India became her family’s lifeline.

Today, the mother of two has six health-related apps on her phone, spanning women’s health to personal fitness, which she uses to connect with her children’s paediatrician and help her 70 year-old mother track and manage her diabetes.

“The world changed. COVID made us all take stock of our health, from what we eat and how much we exercise to how we manage chronic health issues,” Mrs. Sharma said. “I had never set foot in a gym before. Now I have a personal trainer on my phone who tracks my diet and my workout routine.”

The sharp rise in digital adoption, which accelerated during the pandemic, paired with an uptick in GDP and consumer spending is driving demand for new services in a market where healthcare infrastructure is underfunded and overstretched. India’s health sector is straining under a high chronic disease burden, and the doctor to patient ratio is 30% less than World Health Organization recommendations[1] . India’s overall healthcare market is estimated to grow from $167 billion in 2022 to $458 billion in 2030 – and the country’s digital healthcare segment is estimated to grow 10x from $2.7 billion in 2022 to $37 billion by 2030[2].

In our recent report published in collaboration with Boston Consulting Group, A Digital Pill for Revolutionizing Healthcare, we explained how the challenges around access, affordability and quality faced by India’s healthcare system provide unique opportunities for health tech founders.

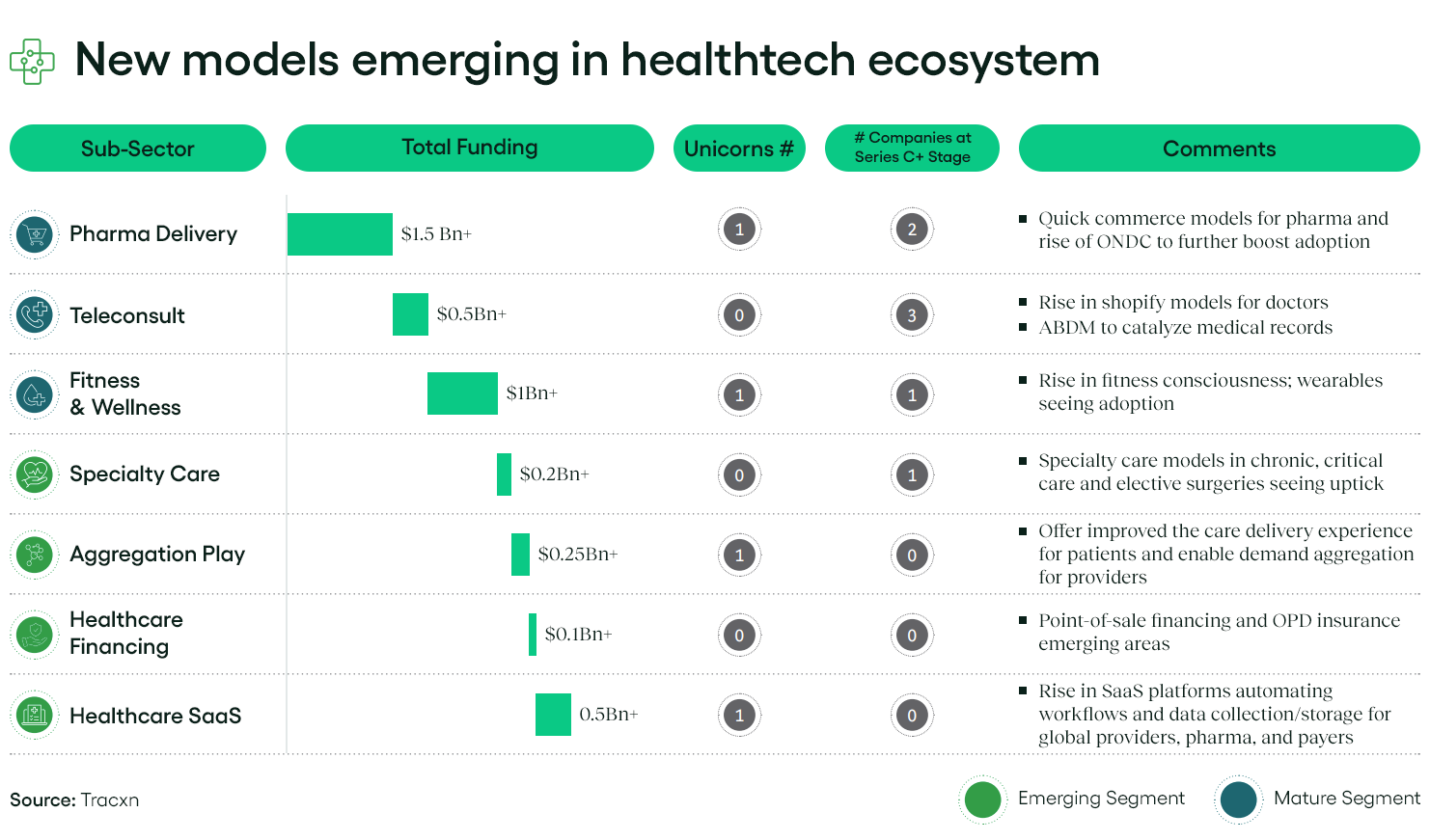

In this post, we highlight seven sectors we believe will give rise to several large, multi-billion-dollar companies over the next 5-10 years.

Fresh opportunities in first wave categories

The first wave of digital health companies that emerged during the pandemic targeted consumers like Mrs. Sharma, who were more open to new patient care models. The companies encompassed three sectors — pharmaceutical delivery, teleconsulting, and the fitness and wellness industries — which have already produced several unicorns like Practo and MediBuddy and large platform startups that have scaled quickly to leadership positions. These companies’ prospects can be further bolstered by policy initiatives from the Indian government.

- In pharma delivery, we are now seeing ‘quick commerce’ models emerge to meet demand from consumers who want their medicine quickly and conveniently. This category is likely to receive support from the Indian government’s new Open Network for Digital Commerce (ONDC) initiative, which aims to democratise access by bringing together merchants and brands on one interconnected digital commerce platform. This will make it easier for consumers to discover hyperlocal care providers and services. In parallel, pharmaceutical startups are adopting a multi-channel approach to expand their reach to acute Rx customers, who may have a more urgent need. B Capital portfolio company PharmEasy has a network of 250+ franchise pharmacies that enhances accessibility to essential healthcare services and medications at the local level.

- Across teleconsulting, we’ve observed a shift to a doctor-centric model. The first wave of teleconsulting services were largely composed of aggregator-platform plays, connecting consumers with a wide selection of doctors. Physicians are now moving to a ‘Shopify’ type model whereby they utilize their own app or platform to connect with their patients, wherever they are, while scaling the reach of their own clinic. Both models would likely benefit from another policy push, such as India’s Ayushman Bharat Digital Mission (ABDM) initiative, which is expected to transform healthcare delivery by creating a unified online platform for all patient health and medical records. Ekra Care, a Bangalore-based startup, currently has a similar service, offering health accounts for patients and a personalized practice management for doctors.

- The fitness and wellness industry in India, having garnered more than US$1 billion in funding over the last decade[3], is expected to drive success for new and existing companies. A new health-conscious generation is increasingly interested in preventive healthcare and willing to pay a premium for support in achieving fitness goals. Platforms like HealthifyMe offer personalized fitness training via mobile phones, while also fostering supportive user communities. The widespread adoption of health wearables extends to senior citizens, reflecting a shift toward digital health monitoring. We believe this market presents a significant opportunity for companies that develop products competing with global brands at more affordable price points.

Riding the second wave of digital health innovation

In a second wave, we expect to see that businesses focus on chronic diseases like diabetes and that provide better access to doctors and hospitals for surgeries by aggregating supply and demand of patients and beds. India suffers from ‘dual disease’ burden with the acute disease burden growing at 6%, while chronic disease burden (diabetes, cardiac diseases, respiratory diseases etc.) is growing at 9%[4]. Specialty care models that enable continuous patient monitoring have emerged to combat this. Aggregator models are also emerging to improve healthcare accessibility for patients in Tier 2+ towns.

Competition and funding are still relatively low, signalling opportunity to early innovators. Healthcare financing and SaaS are also high potential ‘second wave’ categories that have received little investor funding to date.

Here’s where we see opportunity in the second wave:

- Speciality care — Patients are looking for specialized care solutions in various areas, from cancer treatment and obesity to women’s health, creating an opportunity for new companies to fill that market need. Diabetes is a particular area of focus within India, where it is an unfortunate ‘market leader’ for this disease with more than 100 million diabetics in the country. Most of these cases are currently unmanaged, and when people do receive care, it’s a lifelong journey to manage the disease properly. Startups like B Capital portfolio company Sugar.fit offer a lifeline to patients by offering medical and nutritional support as well as an online community of fellow patients to share personal stories about their treatment.

- Aggregation plays — India’s healthcare system is highly fragmented, with doctor shortages and patients across various cities or states who regularly sit on lengthy surgery waiting lists. Companies that enable pooling of resources can help address this gap. For example, Pristyn Care aggregates patients and books operating rooms for physicians across a network of hospitals. Pristyn might book capacity at an underutilised hospital and bring a doctor who can treat multiple patients who require the same surgery nearby. The startup serves both as an aggregator – for patients, doctors, beds and operating theatres – and an end-to-end solution for patients, from booking appointments to providing insurance coverage and scheduling post-surgery care.

- Healthcare financing — Nearly 60% of hospitals in India are run by the private sector, and typically have 300 beds or fewer. In 2022, just 37% of Indians had medical insurance and 55% of all healthcare spending was paid out of pocket. These figures are forecasted to hit 69% and 35% respectively by 2030[5] thanks in part to the government’s Ayushman Bharat scheme, as well as better digital distribution from a new generation of insurance companies. Innovations in this sector include point-of-sale financing, resembling ‘buy now, pay later’ methods that allow patients to pay their bill over several months. Additionally, Outpatient Department (OPD) insurance products leverage AI/ML underwriting models to offer customized pricing and affordable monthly subscription plans for out-of-hospital medical bills.

- Healthcare SaaS – Projections from SaaSBoomi suggest that India’s SaaS industry could attain a value of $1 trillion and generate nearly half a million jobs by 2030. Digital health emerges as a significant SaaS prospect, driven by the abundance of engineering talent and experienced founders. The demand for platforms automating workflows and managing data for global healthcare providers, pharmaceutical companies, and insurers is substantial, both within India and internationally. B Capital portfolio company Innovaccer has gained traction in the U.S. with its Healthcare Data Activation Platform, used by various governments and private institutions for maintaining medical records. We’re particularly excited about SaaS companies that are building at the intersection of health and data or helping pharmacies in clinical research.

The current B Capital global healthcare portfolio includes more than 20 companies in the U.S., Asia and Europe, spanning early venture to late growth venture, across healthtech, digital health, biotech and medtech, led by a cross-border team of investors and operators.

Based on our significant experience, we know building large companies in the healthcare sector can be complex, requiring deep domain expertise, regulatory knowledge, and empathy for end consumers. With the critical goal of improving and saving lives, we’re excited about the opportunities in India, and the number of high-quality, experienced founders with deep sector expertise capable of helping solve the country’s healthcare challenges.

If you’re building for India’s healthcare industry or health tech stack, we’d love to hear from you at info@b.capital

[1] BCG-B Capital (2023), ‘A Digital Pill for Revolutionizing Healthcare’

[2] BCG-B Capital (2023), ‘A Digital Pill for Revolutionizing Healthcare’

[3] BCG-B Capital (2023), ‘A Digital Pill for Revolutionizing Healthcare’

[4] BCG-B Capital (2023), ‘A Digital Pill for Revolutionizing Healthcare’

[5] BCG-B Capital (2023), ‘A Digital Pill for Revolutionizing Healthcare’